Highlights

End-to-end solution provider

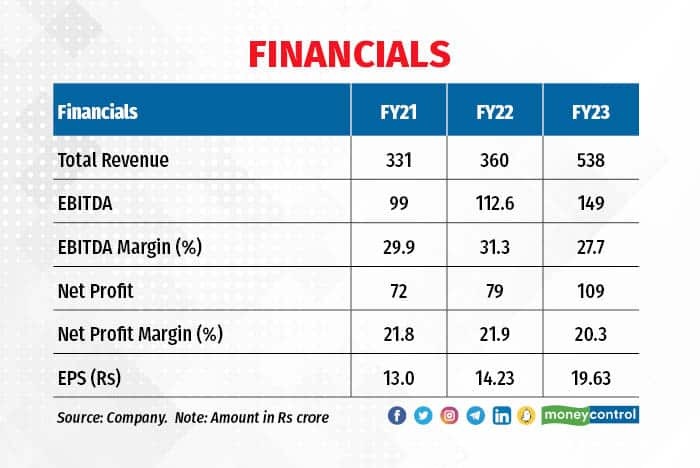

EMSL is an end-to-end solution and technology provider. From procurement, execution to distribution of processed water, the company has developed strong capabilities and enjoys relatively high operating margins. It largely relies on an asset-light model with low fixed asset costs and almost negligible reliance on debt for working capital. This allows the company to earn high operating margins. Its operating margins stood in the region of 28-31 percent, which is the highest among peers in the listed space.

Strong execution capabilities

The company has a strong track record of execution, having successfully completed many critical and challenging projects. Its founder, who has over 35 years of experience and an engineer by qualification, started this business about 12 years back with an initial capability of handling about 4 MLD (million litres a day) projects. Gradually, it has increased its scope of work and reach. Today it can execute projects up to 60 MLD projects. Over the period, it has increased bandwidth and capabilities in different areas of infrastructure-related projects.

Funding growth to next levels

Most of its projects are awarded and funded by state, central and local bodies and some by domestic and international development agencies. Thus, payment is largely secured. On top of this, the company has been extremely conservative about debt. Most of its business was funded by internal accruals and promotors. In fiscal 2023, it had a revenue of Rs 538 crore on a net worth of Rs 487 crore. Debt is zero and it is sitting on a cash and cash equivalent of close to Rs 80 crore. This is quite interesting and this should continue. With the IPO, the company will be infusing about Rs 150-170 crore during the current fiscal (through fresh issue and internal accruals). This will be about double the size of working capital currently employed in the business.

This is crucial from the perspective of growth in the coming years. The company is sitting on an order book of close to Rs 1874 crore, which is 3.5 times its annual revenue. With the infusion of money, it can fund its growth, execution, and undertake larger projects. It is now bidding for projects less than Rs 500 crore. Post the IPO, it will be able to bid for projects worth about Rs 1500-2000 crore.

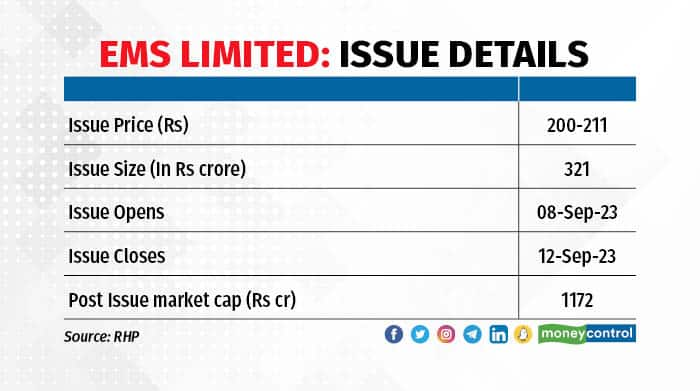

Valuations

Overall, the issue is priced at 10 times its fiscal 2023 earnings, which is quite reasonable in the light of increased funding and strong expected earnings growth. The company is set to deliver strong earnings growth with the help of robust orders in hand and increased funding for new projects. Further, its strong position in the growing water and water treatment space, high margins, zero debt, and robust order book should augur well and reward shareholders.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | DPI, UPI, AI and finding a tech Neverland

Sep 8, 2023 / 02:38 PM IST

In this edition of Moneycontrol Pro Panorama: China's dam in Tibet proves costly for India, cries about AI safety gains momentum, ...

Read Now

Moneycontrol Pro Weekender: The road to 2047

Aug 12, 2023 / 10:56 AM IST

According to an RBI study, we need to grow real GDP by 7.6 percent per annum to be a developed economy. And that target is eminent...

Read Now