Highlights

ENDU stands out as a favoured choice among auto ancillary firms, thanks to its technology-driven product range and dominant position in the two-wheeler segment, supported by its largest domestic client.

Outlook

Positive industry prospects supported by robust order book

ENDU derives a majority of its domestic revenue from the two-wheeler (2W) segment, where it holds a strong position due to its advanced product range. As a result, it is considered a prime candidate for capitalising on the growth in the 2W industry.

Thanks to its robust product portfolio and an increasing share of its clients' business, ENDU consistently outperforms the broader industry.

The management has expressed optimism regarding the long-term prospects of the Indian 2W segment, which is substantiated by the company’s order schedule. The management anticipates a 10-12 percent industry growth in FY24.

In fact, during Q1FY24, ENDU secured new orders totaling Rs 307 crore, excluding those from Bajaj Auto. Notably, within the total order book, there are orders worth Rs 600 crore related to electric vehicles (EVs), including those from Bajaj Auto. Honda Motorcycle and Scooter India (HMSI) was added as a customer in Q1FY24.

Regarding the European business outlook, ENDU's management has emphasised the waning supply constraints, which is enabling original equipment manufacturers (OEMs) to ramp up production. This is evident in the company's double-digit year-on-year (YoY) revenue growth in Q1FY24.

Additionally, ENDU recently secured a significant order worth 17 million euros, including a key order from Volkswagen (VW) for electric vehicles (EVs).

In summary, ENDU's strong position in the Indian 2W segment, coupled with its focus on EVs and favourable market conditions, positions it as a compelling player in the automotive industry.

Outperformance driven by new products

The company remains dedicated to enhancing its product portfolio with a focus on high-value offerings, which encompasses brake-and-clutch assemblies designed for motorcycles, with engine capacities exceeding 200cc, ABS systems, paper-based clutches, inverted front forks, as well as fully machined and semi-finished castings. Notably, the company has already initiated the supply of ABS and brakes tailored for motorcycles with engine capacities of 200cc and above, and the supply of clutch plates has also been initiated.

Enhanced margins expected as raw material prices ease

Raw material (RM) costs have started to decline, with the positive impact becoming evident from Q4FY22. Additionally, the previously high energy prices in Europe during Q2FY23 have declined, leading to improvements in the company's operating margin.

Furthermore, the management is actively concentrating on enhancing cost efficiencies, introducing higher value-added products, and substituting imports to enhance the operating margin.

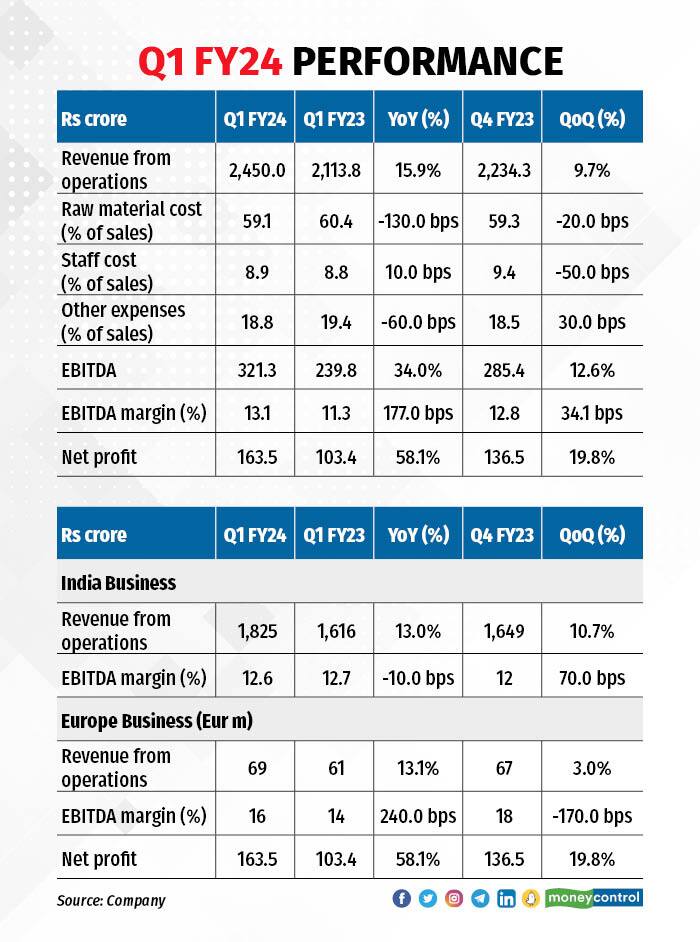

Q1FY24 snapshot

.

.

Key highlights

A key highlight from ENDU's financial performance in Q1FY24 is the remarkable rebound in the EBITDA (earnings before interest, tax, depreciation, and amortization) margin of its European business, which saw a substantial 240 basis points (bps) expansion year on year (YoY). This expansion can be attributed to a significant reduction in energy costs and an energy cost pass-through arrangement with its clients.

Another noteworthy aspect of the results is the revenue growth in ENDU's India business, despite a less favourable industry environment. This growth is attributable to an increase in content per vehicle resulting from the introduction of new products and a diversified product mix. The EBITDA margin for the Indian business remained stable during this period.

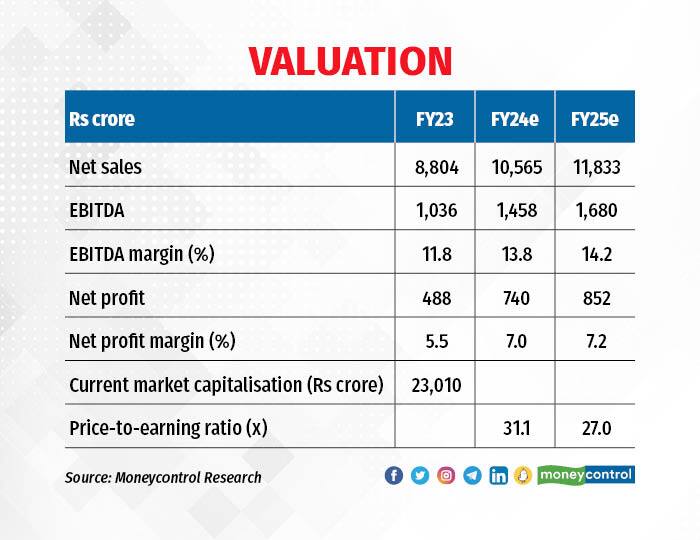

Valuation: trades at discount to long-term average

ENDU's current trading valuation stands at 27 times the projected earnings for FY25, representing a 17 percent discount compared to its six-year average valuation of 32.7. This discounted valuation offers significant room for a stock price upmove. We recommend investors to consider accumulating the stock gradually.

Risks

A deceleration in demand may have adverse effects on the financials, and unfavourable commodity prices could lead to higher raw material expenses, potentially affecting operational profitability.

For more research articles, visit our Moneycontrol Research page.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | DPI, UPI, AI and finding a tech Neverland

Sep 8, 2023 / 02:38 PM IST

In this edition of Moneycontrol Pro Panorama: China's dam in Tibet proves costly for India, cries about AI safety gains momentum, ...

Read Now

Moneycontrol Pro Weekender: The road to 2047

Aug 12, 2023 / 10:56 AM IST

According to an RBI study, we need to grow real GDP by 7.6 percent per annum to be a developed economy. And that target is eminent...

Read Now