With Housing Development Finance Corporation (HDFC) merging into HDFC Bank, about Rs 1.5 lakh crore of bank limit is now available for other non-banking financial companies (NBFCs) as well as housing financiers, said analysts.

According to the regulatory cap set by the Reserve Bank of India (RBI), banks cannot have an exposure of over 20 percent of their Tier 1 capital in a single NBFC and over 25 percent in one NBFC group.

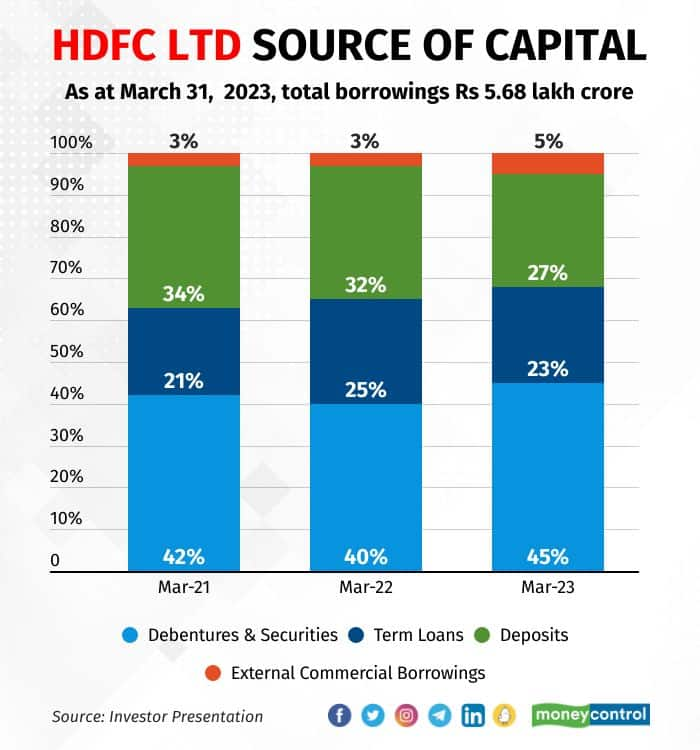

As at March 31, 2023, HDFC Ltd’s total borrowings stood at $69.14 billion. Of these, term loans from banks made for 23 percent, roughly amounting to $15.9 billion or Rs 1.5 lakh crore. “This exposure of HDFC Ltd to the financial system has moved out of the NBFC/HFC classification,” said analysts.

This does not necessarily mean that the cost of funds will come off, but the quantum of money an NBFC can raise from banks at the same cost is now much higher.

While the entire sector stands to benefit, foreign broking firm Nomura thinks this is a big positive for Bajaj Finance and its housing finance subsidiary Bajaj Housing Finance Ltd, from a ‘liability-garnering and finer-pricing perspective’.

“Bajaj Finance has a well-diversified liability franchise, which, coupled with its AAA rating, strong parentage, prudent asset-liability management, and robust track record, has led to declines in the gap of funding cost with large banks over the past few years,” Nomura analysts Ajit Kumar and Param Subramanian wrote in a note dated August 24.

A veteran banking analyst, who did not wish to be named, agrees. Funds will be easily available to NBFCs that have a proven ownership and track record, he said. “The reason why Indostar Finance may not get money from banks but a Jio Financial Services or a Cholamandalam Finance will is because of ownership,” he said.

“If something goes wrong, a bank needs somebody to catch hold of. Private equity is not considered a very reliable counterparty by banks. They look for solid promoters,” he said.

Currently, bank lines account for 30 percent of Bajaj Finance’s liability mix, 49 percent of Cholamandalam’s and 24 percent of Shriram Finance’s. Meanwhile, non-convertible debentures make up 15 percent of Cholamandalam’s liability mix, 17.7 percent of Shriram Finance and ~35 percent of Bajaj Finance.

According to Gagan Singla, managing director at BlinkX, an initiative by JM Financial, NBFC paper is also an area where demand is in excess of supply and that will be accentuated after the HDFC merger. Commercial papers account for 6-10 percent of borrowings by top NBFCs currently.

“Demand is likely to remain robust as NBFCs offer higher rates of interest for borrowings. Other NBFCs will now get in to fill that space. Both the client base's penetration levels for the home loan product and the degree of distribution leverage are relatively low,” Singla said.

This means subsidiaries like Shriram Housing Finance, Chola Home Loans and Sundaram Home Finance could go aggressively into lending, once their parents get more capital.

Furthermore, Mataprasad Pandey, vice president of Arete Capital Services, believes LIC Housing Finance will also be a major beneficiary in terms of market shares as well as increased borrowing limit as it is owned by LIC.

Outlook for NBFCs

Axis Capital anticipates that the impact of peaking interest rates will fully manifest in FY24, following which NBFCs’ net interest margins (NIMs) are expected to stabilise with a positive bias.

Over the course of the last 15 months, the Reserve Bank of India (RBI) has implemented rate hikes totalling approximately 250 basis points (bps). This has led to increased funding costs for NBFCs, although the complete impact is yet to be observed due to the lag in the repricing process.

While there are no major challenges on the asset quality side yet, analysts have started becoming wary of the rapid build-up in unsecured loan book which can become problematic, going ahead.

For the time being, most brokerages believe NBFCs’ valuations are comfortable as they increasingly focus on loan book diversification and development of granular businesses supported by digital capabilities.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!