Highlights

Company brief

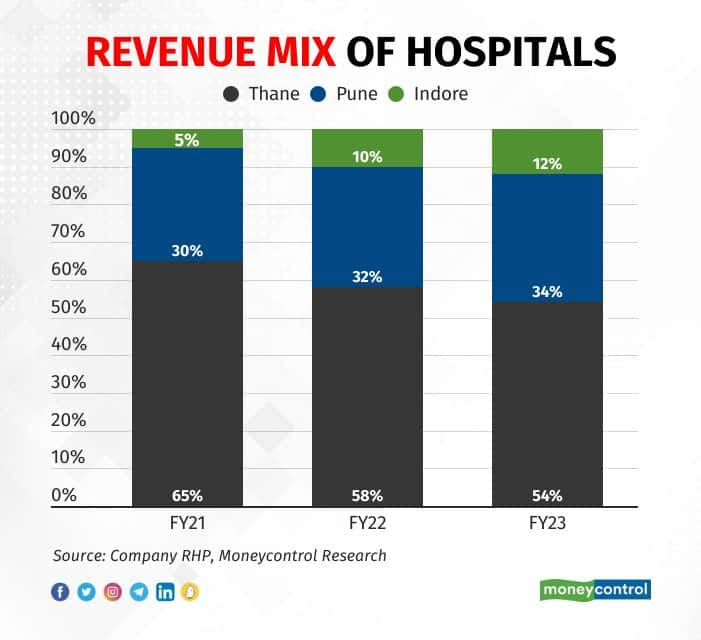

JLHL is a quaternary healthcare provider in the Mumbai Metropolitan Area (MMR) and western region of India. Incorporated in 2002, JLHL currently owns three hospitals -- in Thane (started in 2007), Pune (started in 2017), and Indore (started in 2020) – having a combined capacity of 1,194 beds and operational capacity of 950.

Currently, the company is developing its fourth hospital in Dombivli, Maharashtra, which commenced construction in April 2023 and would have a capacity of 500 beds.

IPO details

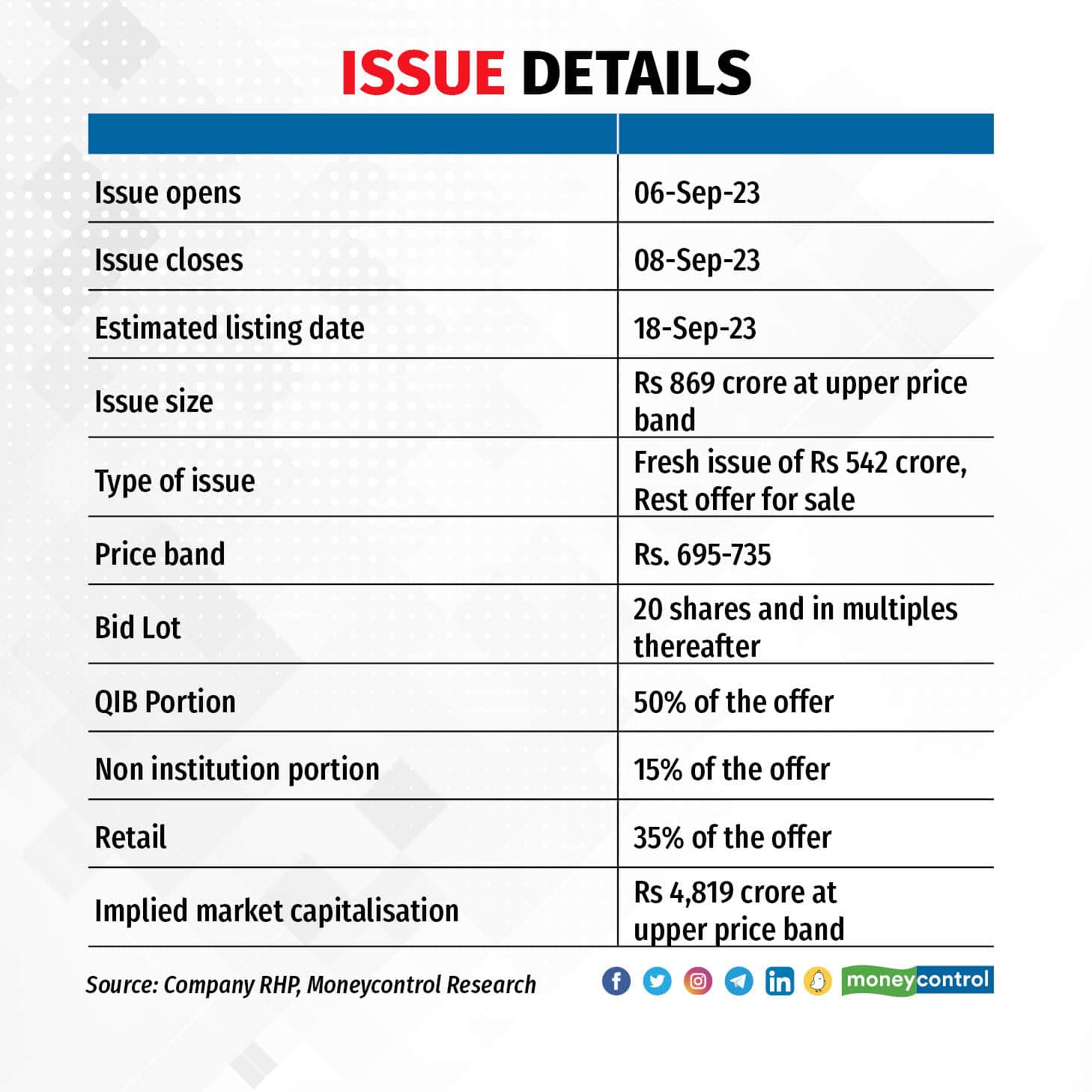

Of the proceeds from the fresh issue, ~Rs 510 crore would be utilised to pay back the debt of the company and its key subsidiaries, while the rest would be utilised for general corporate purposes.

.

.

After listing, the promoters and promoter group’s combined shareholding will come down to 40.9 percent from the current 49.8.

Key operational highlights

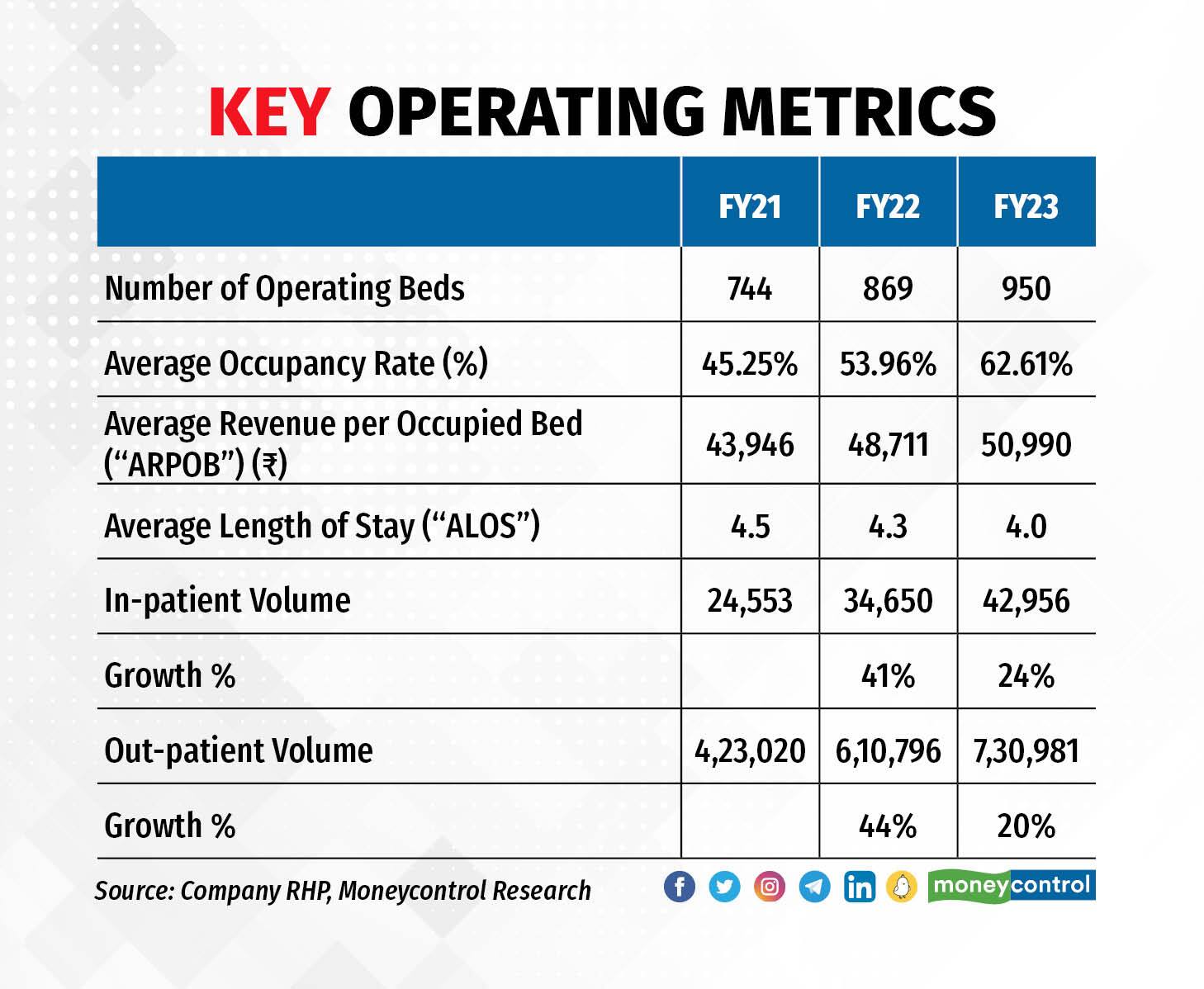

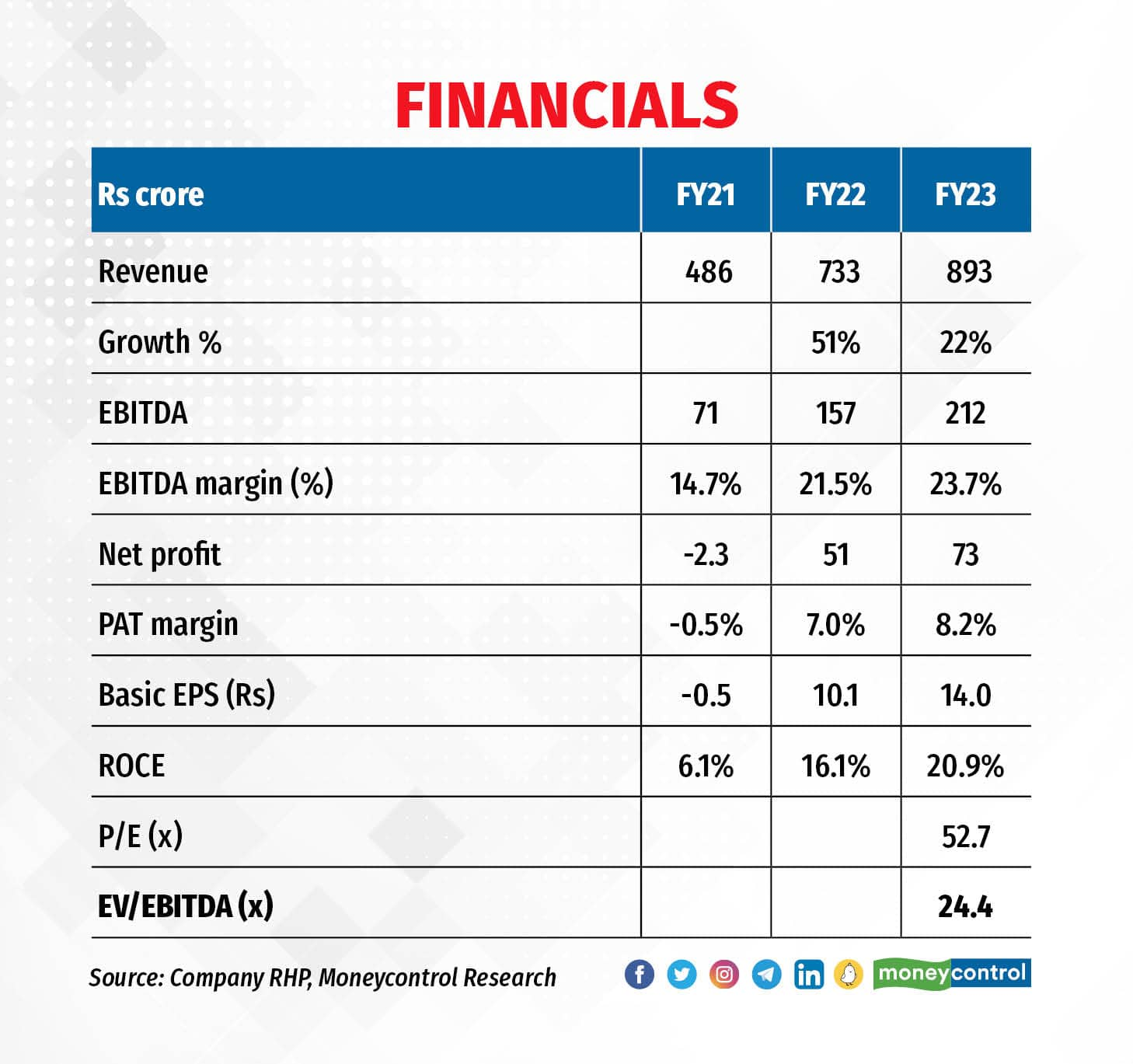

The company’s revenue and earnings before interest, tax, depreciation and amortization (EBITDA) grew at a CAGR of 35 percent and 72 percent over FY21-23, respectively. Operating margin expanded from 15 percent in FY21 to 24 percent in FY23.

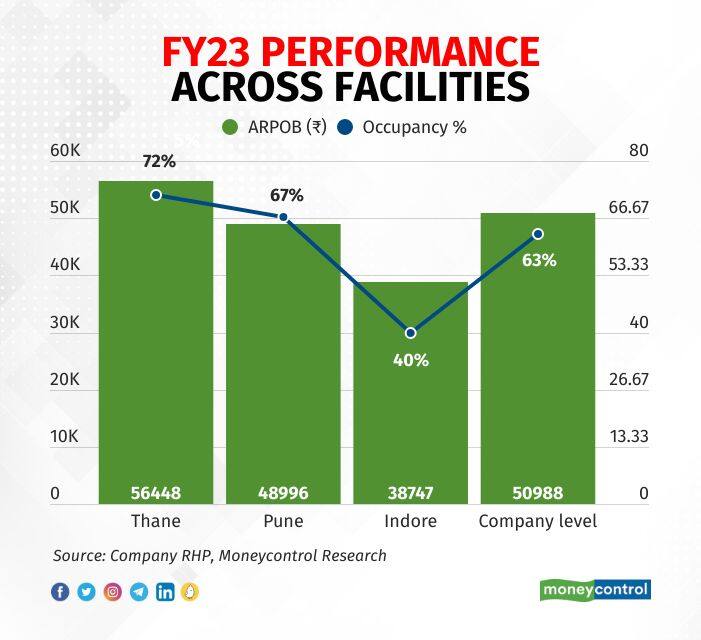

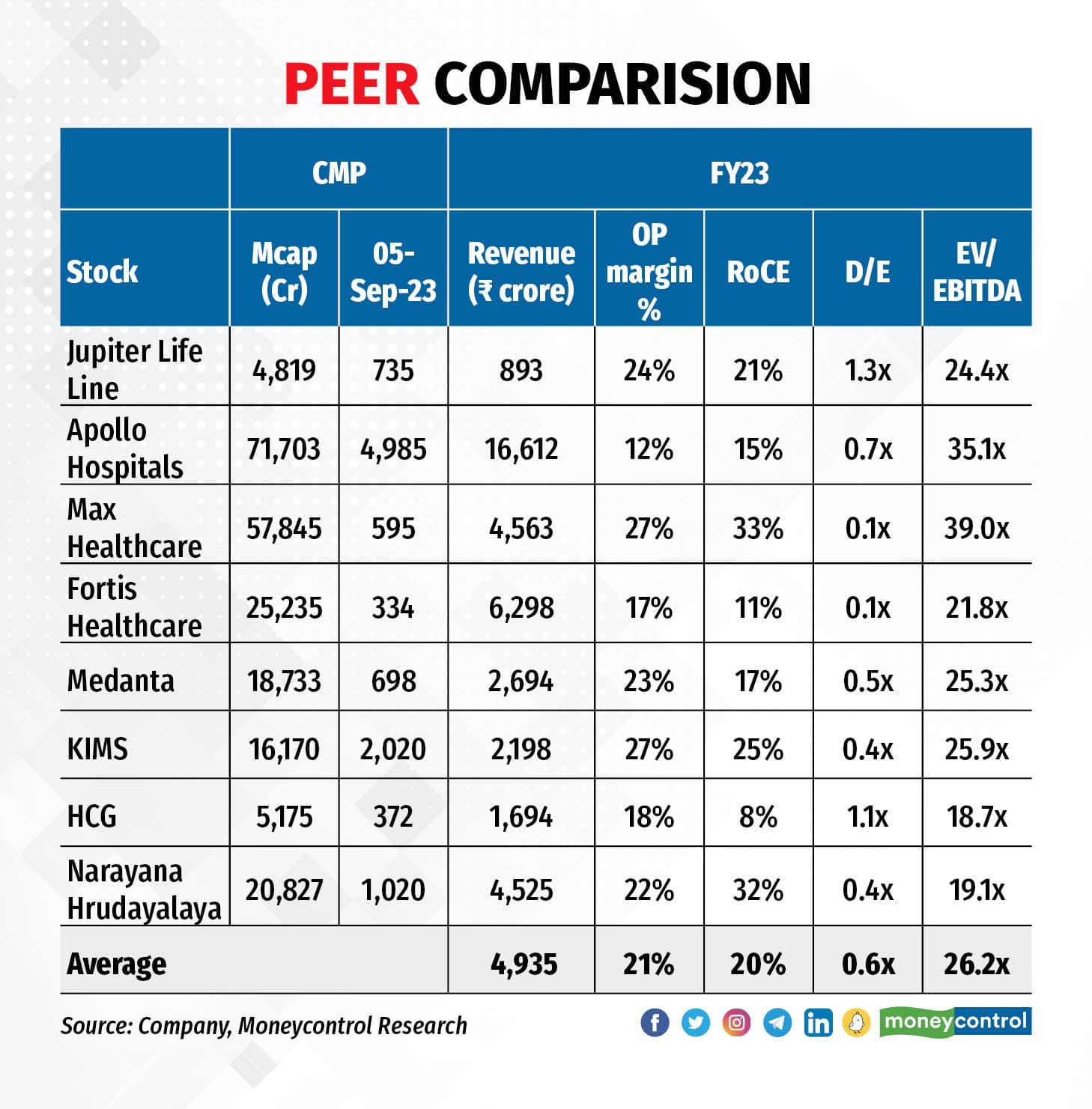

The average revenue per operating bed (ARPOB) increased by 16 percent to ~Rs 50,990 in FY23, compared to Rs 43,946 in FY21. Compared to its peers, JLHL’s ARPOB is in line with that of Apollo and Fortis hospitals -- the other close peers in the western region.

Its bed occupancy rate of ~63 percent is in line with the industry average of 60-65 percent.

The company’s cash conversion, i.e., the ratio of cash flow from operations to EBITDA, has remained healthy at above 80 percent in the past two years. However, the leverage is on the higher side, with a debt-equity ratio of 1.3x.

Opportunities ahead

All the existing hospitals are owned by JLHL and so is its new hospital in Dombivli, which is expected to commence operations in the next 2-3 years. JLHL prefers to own its assets and is focused on the western region of India for future expansion. The company plans to add more hospitals in the region and establish a network with ~2,500 bed capacity in the next few years.

Its Thane hospital is operating at a near peak occupancy of ~72 percent. However, the Pune hospital has further room for capacity expansion. Furthermore, the Indore hospital is operating at a lower ARPOB and occupancy and turned EBITDA breakeven at the end of FY23. There is immense scope for this facility to scale up its operations and will be critical for the company’s overall growth in the near term.

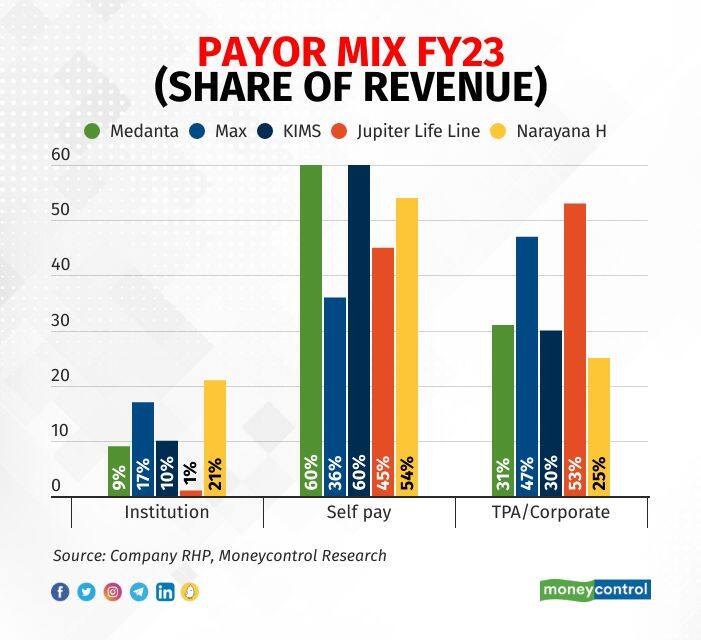

JLHL’s payor mix is quite healthy as the institutional (CGHS, govt scheme) mix is just about ~1 percent, which is extremely low, compared to its listed peers’ range of ~10-20 percent. This should support the company’s ARPOB at a higher level and keep the receivable days in good shape, going into the future.

The company’s gross debt stood at Rs 476 crore, with a debt/equity ratio of 1.3x, as at FY23, which is high, compared to the industry average of 0.6x. But JLHL plans to utilise a major portion of the IPO proceeds for debt repayment, which should significantly deleverage the company and leave room to raise funds later.

Valuation and recommendation

The offer price implies the business being valued at 24x EV/EBITDA for FY23, which is close to the industry average and leaves limited scope for re-rating.

However, there is a huge disparity in the population and the healthcare infrastructure in the company’s focused area of MMR region and the micro markets of west India. This leaves enough room for JLHL to cement its footprint in this region. We advise investors to ‘subscribe’ to the issue for the long term.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | DPI, UPI, AI and finding a tech Neverland

Sep 8, 2023 / 02:38 PM IST

In this edition of Moneycontrol Pro Panorama: China's dam in Tibet proves costly for India, cries about AI safety gains momentum, ...

Read Now

Moneycontrol Pro Weekender: The road to 2047

Aug 12, 2023 / 10:56 AM IST

According to an RBI study, we need to grow real GDP by 7.6 percent per annum to be a developed economy. And that target is eminent...

Read Now