For most people, the true meaning of financial freedom is having enough money to be able to retire from your day job without a worry. This can be achieved by following good financial habits, like proper planning and investing.

According to financial advisors, one of the preferred routes to achieve this is by investing in mutual fund schemes through systematic investments plans (SIPs). And an increasing number of Indians are doing just that. For instance, the mutual funds industry saw SIP inflows top Rs 15,000 crore for the first time to touch Rs 15,245 crore in July 2023, against Rs 14,735 crore in June. Moreover, in July, an impressive 33.06 lakh new SIPs were started.

A crorepati @Rs 7,000

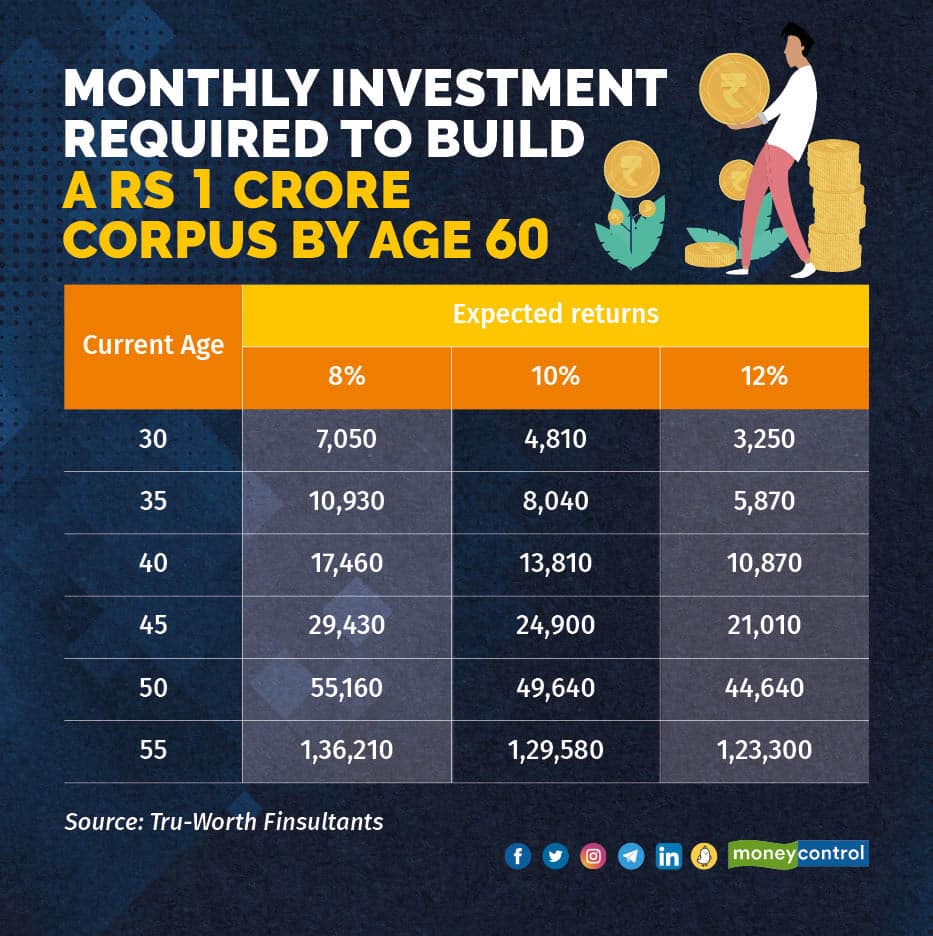

If you invest Rs 7,000 every month starting August 2023, then you would have invested Rs 25.2 lakh over 30 years. With the power of compounding, you can achieve a corpus of Rs 1 crore in this period, assuming your portfolio grows at 8 percent per annum.

According to Tivesh Shah, founder, Tru-Worth Finsultants, if your investment portfolio has some exposure to equities, and if it grows at 10 percent every year, you could manage a Rs 1 crore corpus in 30 years even by investing Rs 4,800 monthly (see graphic). “We focus on returns alone but forget the role of time, which could help us reach our target even with a lower investment,” he says.

Suppose you start investing only when you’re about 40 for your retirement corpus of Rs 1 crore. Then, you will have to invest Rs 17,400, assuming 8 percent returns, or Rs 10,900, assuming 12 percent returns.

How much is required for retirement?

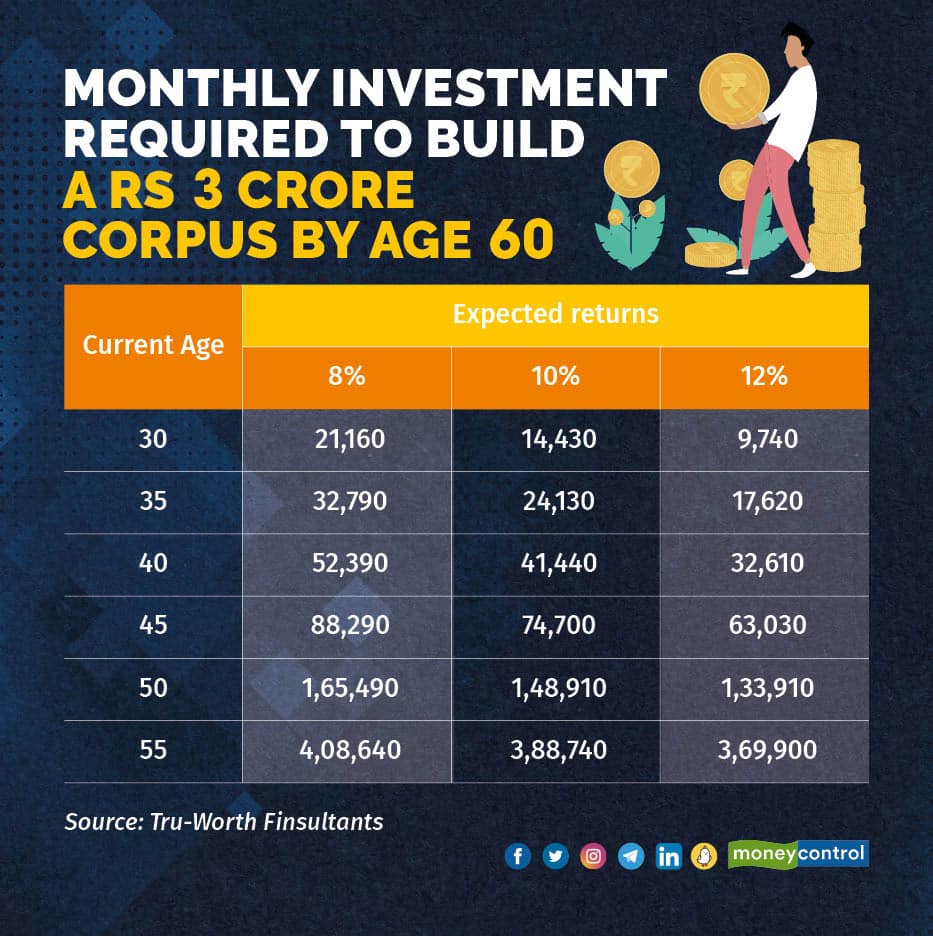

Dev Ashish, a SEBI-registered investment advisor (RIA) and founder, StableInvestor, says, “A corpus 30-40 times your current annual expenses is good for achieving financial freedom. So, if your annual expenses (not income) are about Rs 10 lakh, then using the 30-40X norm, a corpus of Rs 3-4 crore is what you need.”

For instance, say you want to build a corpus of Rs 3 crore for your retirement at the age of 60. If your current age is 35, then you should start a monthly SIP of Rs 24,000 for 25 years, assuming 10 percent returns.

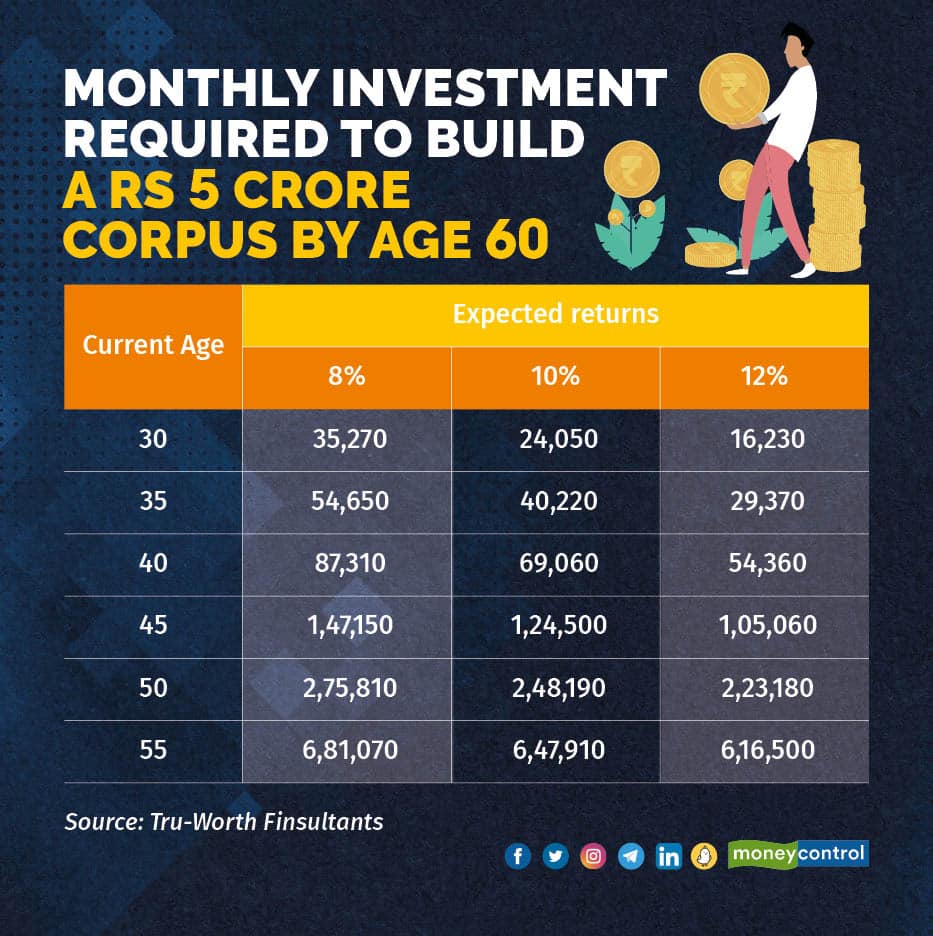

Similarly, if you want to build a retirement corpus of Rs 5 crore, and you are now 35, then you need a monthly SIP of Rs 40,200 / Rs 29,300 for 25 years, assuming 10 / 12 percent returns (graphic below).

Make a financial plan

Once you have identified your target corpus, the next step is to prepare a financial plan to achieve the same. Parimal Ade, co-founder of InvestYadnya.in says, “Set clear, actionable goals, and work towards achieving them. Don't get intimidated. Financial planning is more of a behavioural thing than an intellectual one.’’

Your investment plan should account for lifestyle expenses, inflation, healthcare, life expectancy estimates, and the age by which the retirement corpus would be exhausted.

“There may be unplanned recurring expenses that might come up, such as house renovation, upgrading to a new car, etc. These expenses need to be factored in when you're thinking about your retirement corpus,” says Vishal Dhawan, founder and CEO, Plan Ahead Wealth Advisors.

Also read | Top performing mutual fund schemes from MC30 funds

Protect your corpus

Unrealistic assumptions can derail your plans for financial freedom. “If you are overly optimistic in your assumptions, then you will mess up badly,” says Ashish.

“While building a retirement corpus, don’t take unnecessary risks and make speculative investments, or invest in cryptocurrencies, etc.,” says Rishi Piparaiya, author and financial mentor. Keep the retirement corpus aside and don’t gamble with it in equity markets post-retirement, he adds, noting that if you lose it, you are not financially independent anymore.

“Also, you need to protect your corpus as you get closer to your retirement, because bad returns for a few years at that time can really mess up your plans,” adds Ashish.

“Many people feel that to be financially free, you need to earn a lot. But that’s not entirely true. Earning well helps. But it’s not enough,” says Ashish.

You should be ready to invest at least 30 percent of your take-home pay. Just investing 10-20 percent of your income will not help you achieve your financial corpus. Consult a good investment advisor to work out how much you need to invest.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!