Old Bridge Capital Management, a portfolio management firm, has received the final approval from the Securities and Exchange Board of India (SEBI) to commence its mutual fund operations, it announced on September 6.

Old Bridge Mutual Fund when launched will become the 48th fund house in the Rs 46 lakh crore asset management industry in India.

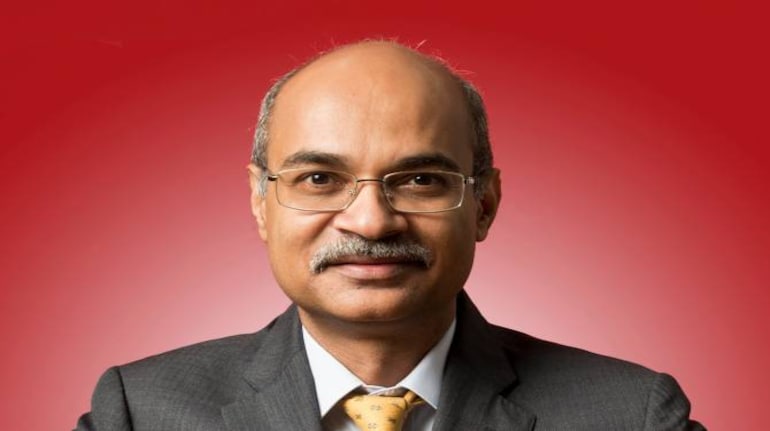

Founded by Kenneth Andrade, Old Bridge Capital Management was incorporated in December 2015.

"We are delighted to receive this license to commence operations for Old Bridge Mutual Fund and will be launching our maiden actively managed equity scheme. As we move forward with our newly acquired license, we remain committed to providing investors with long term investment solutions on its mutual funds platform as well,” said Kenneth Andrade, Founder & Chief Investment Officer, Old Bridge Capital Management.

Also read | Why WhiteOak Capital’s new fund doesn’t offer a dividend option

This is kind of homecoming for Andrade, who was head-Investments at IDFC Mutual Fund for 10 years during 2005 to 2015.

Before IDFC MF, he was fund manager-equities at Kotak Mahindra Asset Management Company.

The mutual fund space in India is heating up with the entry of new fund AMCs.

Last month, Helios Capital Management had received final approval from SEBI. Samir Arora, who founded Helios Capital Management, a PMS, in 2005, had also worked in the mutual fund industry earlier.

Also read | Credit card rewards: When the wrong Merchant Category Code can be costly for cardholders

Helios Mutual Fund as so far applied for two schemes, flexi-cap and overnight funds, with the capital markets regulator.

Meanwhile, Zerodha Asset Management Ltd, one of India’s newest fund houses, is also getting to ready to launch mutual fund schemes, nearly a month after it got its final license.

In keeping with its mandate to launch passive scheme, Zerodha has filed draft offer documents with the market regulator to launch two schemes -- Zerodha Tax Saver (ELSS) Nifty Large Midcap 250 Index Fund and Zerodha Nifty Large Midcap 250 Index Fund (ZN250).

Also read | Should you take an accidental death benefit rider with your life insurance policy?

Further, brokerage firm AngelOne and Emkay Global Financial Services had earlier received in-principle approvals from SEBI for mutual fund business.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!