Highlights

A high-quality financial services player

Uday Kotak has taken measured steps so far to build a high-quality bank. He has taken a calibrated approach in growing the bank’s book. After weathering the Covid storm well, the bank is now pressing the pedal on loan growth.

The momentum in loan growth continued to be strong for the eighth consecutive quarter and in Q1 of FY24 it grew by over 19 percent, supported by all segments except agriculture and corporate. The traction in unsecured segments — such as credit cards, personal loans, etc. — was strong and the share of unsecured in total advances stood at 10.7 percent with headroom to grow.

After a lacklustre phase, the deposit drive of the bank is beginning to yield results with a sequential surge in deposits of 6.4 percent in Q1, ahead of the sequential loan growth of 2.7 percent, leading to a moderation in the credit-to-deposit ratio. The bank is aggressively pushing its hybrid savings product ActivMoney, under which savings account balance beyond a threshold would get switched to term deposits, earning a higher rate with no penalty on withdrawal. While this stands to impact the CASA growth, the bank gets access to a large pool of resources at a blended rate lower than term deposits. Early success is seen with the product showing a 24 percent sequential growth.

As guided by the management earlier, the net interest margin peaked by the end of the previous fiscal at 5.75 percent. With 80 percent of the book floating, a large part of asset repricing is over and deposits are now catching up. Hence, there was a sequential moderation in interest margin (NIM) to the tune of 18 basis points in Q1 FY24. Further moderation is expected in the coming quarters. However, riding on an improved share of better-yielding unsecured loans and a deposit push, through a hybrid product less costly than term deposits, the bank is confident of maintaining a healthy NIM of above 5 percent.

With a risk-adjusted approach to growth, the asset quality has never been a point of bother. It continued to remain best in class at the end of Q1 — gross and net NPAs of 1.77 percent and 0.4 percent respectively, with a provision cover of 78 percent. The credit cost in the last quarter was annualised 54 basis points. It has a negligible restructured book of 19 basis points of advances that carries a provision of over 25 percent.

The bank is well capitalised with a capital adequacy in excess of 21 percent to embark on a growth journey.

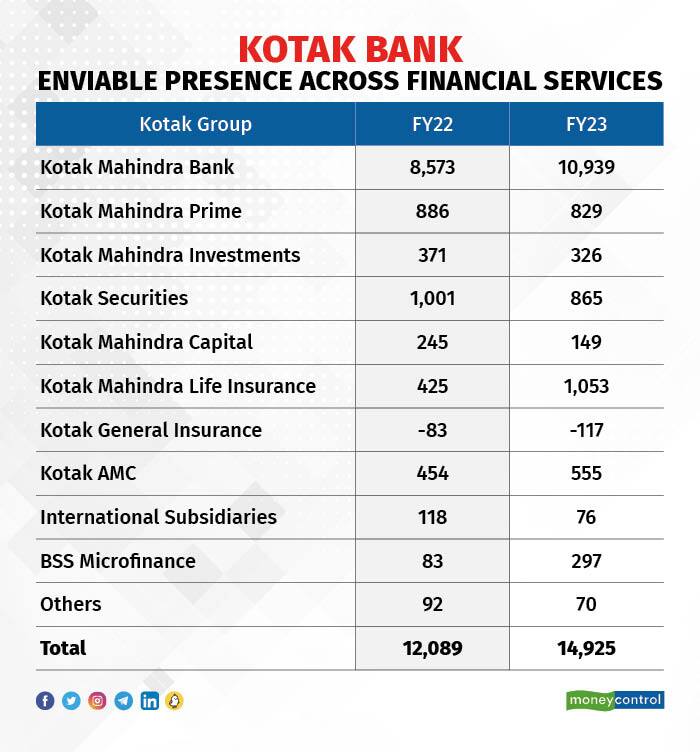

A full-fledged financial service play

The bank has an extensive presence in financial services through a gamut of subsidiaries. They remain significant value drivers as financialisation of the Indian economy gathers pace.

Source: Company

Source: Company

Valuation post correction

Kotak Bank remains a great core play in Indian economy’s growth journey. The recent correction has brought the stock to a more reasonable valuation of 2.3x FY25 core book. Should the stock correct/consolidate further, the valuation could turn attractive.

Uday Kotak has resigned – but the bank remains his child

If Uday Kotak’s resignation satisfies the regulator and allows him to continue to hold a board position in non-executive capacity, it should be seen as a welcome development. Even if it is not permitted, all is not lost. There remains a possibility of Kotak being reconsidered for the top job after a mandatory cooling off period of three years. Someone from his family getting groomed for the top job is also highly probable. There is little doubt that as the principal shareholder, with close to 26 percent stake, Uday Kotak has deep skin in Kotak Bank and he would ensure a rewarding journey for himself and the shareholders. While the road ahead may look a tad blurry at this stage, it could turn out to be as rewarding as the past.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | DPI, UPI, AI and finding a tech Neverland

Sep 8, 2023 / 02:38 PM IST

In this edition of Moneycontrol Pro Panorama: China's dam in Tibet proves costly for India, cries about AI safety gains momentum, ...

Read Now

Moneycontrol Pro Weekender: The road to 2047

Aug 12, 2023 / 10:56 AM IST

According to an RBI study, we need to grow real GDP by 7.6 percent per annum to be a developed economy. And that target is eminent...

Read Now