Highlights

Q1FY24 Financial Performance

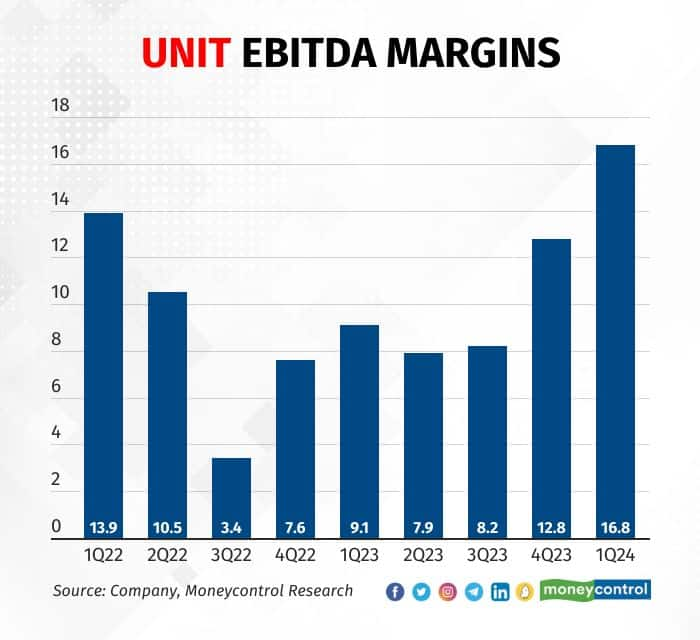

Price cut can support volume growth

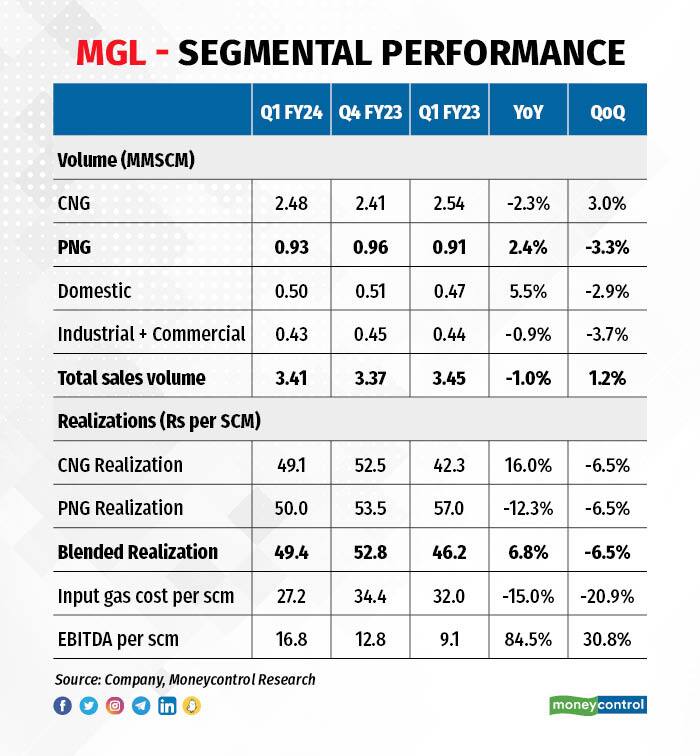

The April-June period this year (Q1) was the first quarter after the implementation of the new domestic gas price of $6.5/MMBtu and MGL passed on the cost savings promptly to consumers. Lower CNG (Compressed natural gas) prices helped in a demand turnaround after three consecutive weak quarters. Vehicle conversion also grew to 14,750 in Q1 against 13,500 in Q4, signalling a demand pick-up. Soft domestic gas prices along with $10-12/MMBtu LNG (Liquified natural gas) gas price, improve the odds for further price cuts. The MGL management sees long-term unit EBITDA of Rs 10-11 per scm, thereby leaving sufficient room for a further cut in retail CNG prices to spur demand.

Gas prices are unlikely to go to the levels of last year

Post a challenging FY23 on high LNG prices, CGD companies now appear to be well placed on viable gas pricing, thereby retaining their profitability. As the winter season approaches, fear that gas shortage in Europe could push prices high again seems to be overblown. First, European nations are better prepared this time with their gas storage already above 90 percent of the overall capacity. Second, an ongoing slowdown in the Chinese economy will dent its gas demand. Both are supportive of lower gas prices and, by extension, improvement in unit margin and volume.

Outlook

MGL began FY24 on a good note as gas costs got cheaper and led to record margins. This is expected to continue in the light of persistent weakness in gas prices, domestic policy support, and a rise in gas consumption. MGL’s management is confident of achieving at least 5-6 percent volume growth and Rs 10-11 EBITDA per scm over the long term. This appears credible as gas prices are not expected to rise significantly in the near term. Moreover, the development of existing GAs and the planned acquisition of Unison Enviro are going to provide sustained demand as gas replaces other fossil fuels.

The company plans to spend around Rs 600-800 crore in FY24, of which Rs 150 crore has already been spent on CNG station construction and the laying of pipelines. Around 500-600 CNG buses are to be added to the MSRTC's (Maharashtra State Road Transport Corporation) fleet over the next 2-3 quarters, which, at 80kg /day per bus gas consumption, is expected to improve MGL's volume growth. Also, MGL plans to set up LNG stations over the next 12-18 months with Baidyanath LNG and signed an MoU with BMC (Brihanmumbai Municipal Corporation) to set up a compress biogas plant.

We are of the view that there is a scope for price revision to drive volume in CNG & PNG - Industrial & Commercial. This would help offset lower realisations, while maintaining the EBITDA margin within the long-term guidance range.

Valuation

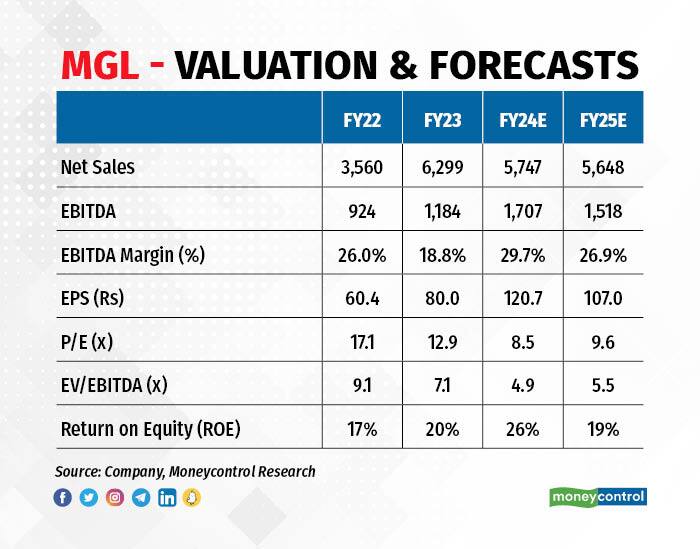

MGL’s stock price performance has been flat in the last three months over concerns about volume growth, and LNG prices, which in our view are overstated. At the current market price, the stock is trading at a FY25 PE of 9.6x, which is at a significant discount to its long-term average and therefore has an upside from the current levels. Investors can add the stock with a medium-term view.

Risks

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | DPI, UPI, AI and finding a tech Neverland

Sep 8, 2023 / 02:38 PM IST

In this edition of Moneycontrol Pro Panorama: China's dam in Tibet proves costly for India, cries about AI safety gains momentum, ...

Read Now

Moneycontrol Pro Weekender: The road to 2047

Aug 12, 2023 / 10:56 AM IST

According to an RBI study, we need to grow real GDP by 7.6 percent per annum to be a developed economy. And that target is eminent...

Read Now