HDFC Bank recently tied up with Marriott Bonvoy, the loyalty programme of the leading hotel chain Marriott International, to launch the Marriott Bonvoy HDFC Bank Credit Card. This is the first co-branded hotel credit card to be launched in India.

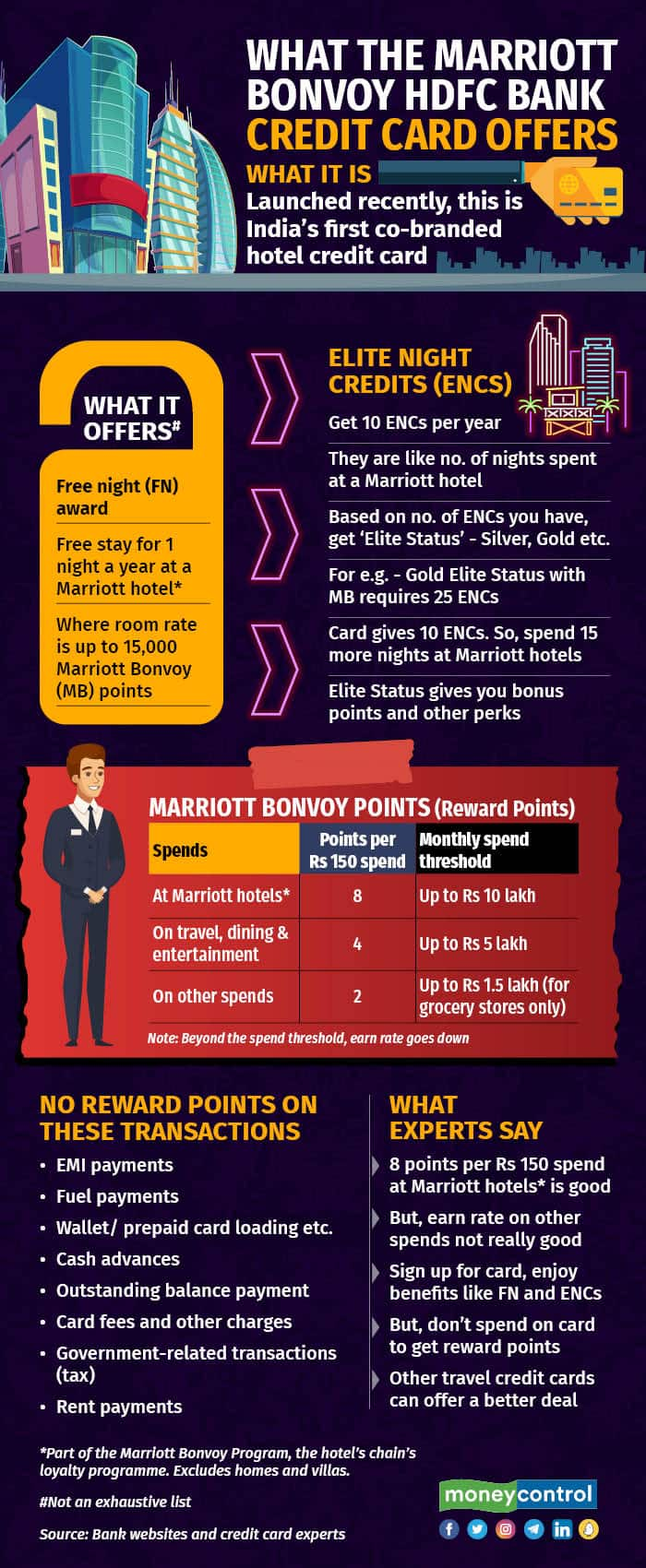

Among the big attractions of the card are one free night’s stay and 10 elite night credits under the Marriott Bonvoy Program when you first sign up and every subsequent year, on payment of the annual fees. The card also offers attractive reward points for spends at Marriott hotels.

The Marriott Bonvoy HDFC Bank card comes with a joining/annual renewal fees of Rs 3,000 plus taxes. Unlike some other credit cards, this one does not have an annual fee waiver option.

Key benefits

The one free night award, as the name suggests, entitles you to free stay for a night at a Marriott property with a redemption level of up to 15,000 points. That means you can redeem points for a night’s stay in a standard room at a hotel that is part of the Marriott Bonvoy Program and costs up to 15,000 points (inclusive of room rate and applicable taxes). You are also allowed a top-up. So, if you want, you can book a room with a higher tariff by redeeming up to 15,000 points along with your free night award.

This HDFC co-branded credit card also entitles you to 10 elite night credits (ENCs) which can help you get an ‘Elite Status’ in the Marriott Bonvoy Program. These are not to be confused with Marriott Bonvoy points - reward points you earn on spends. (see table for details)

Under the Marriott Bonvoy Program, depending on the number of nights you have stayed at a Marriott property in a year, you get an ‘Elite Status’, which can range from Silver Elite to Ambassador Elite at the top end.

For example, you need 10 nights’ stay at a Marriott property—or in other words, 10 ENCs—a year for Silver Elite status and 25 nights a year for Gold Elite status. “This, in turn, can get you bonus points and other perks (like complimentary breakfast, upgrades, lounge access, late checkout, etc., depending on the elite status) from Marriott Bonvoy,” said Ashwin, a credit card enthusiast who tweets at @drgrudge.

So if you need 25 nights a year to get Gold Elite status and you already have 10 ENCs thanks to your Marriott Bonvoy HDFC Bank card, then you need only 15 more nights’ stay at Marriott hotels to be conferred the higher status.

Note that the free night award you get at the sign-up or when renewing the card is valid for up to 12 months. The ENCs, on the other hand, expire on December 31 each year, irrespective of the month in which you received the card.

Earn Marriott Bonvoy points

Apart from these two benefits, spends on this card can fetch you reward points much like in the case of other credit cards, only here they are referred to as Marriott Bonvoy points. You can redeem these for stay at Marriott properties.

So, what is the earn rate for this card?

You can earn eight Marriott Bonvoy points for every Rs 150 spent at properties (excludes homes and villas by Marriott) that are part of the Marriott Bonvoy Program up to a monthly spend threshold of Rs 10 lakh. Beyond this limit, you earn 2 points per Rs 150. These spends could be on the room tariff, restaurants etc. as long as they are wholly owned or managed by the Marriott.

However, certain purchases, say at a retail outlet (operated by a third party) located within a participating Marriott Bonvoy property may not be eligible for points at this rate. Similarly, if your hotel arranges for a cab that is provided by an external taxi company, spends on that will not qualify for rewards at this rate.

Next, for spends on three categories—travel, dining and entertainment—you earn 4 Marriott Bonvoy points per Rs 150 spent up to a monthly spend threshold of Rs 5 lakh. Beyond that, the earning rate goes down to 2 points for every Rs 150 spent.

For all other spends, you get 2 Marriott Bonvoy points per Rs 150 spent. But on grocery-related spends, you earn points only up to a monthly spend threshold of Rs 1.5 lakh. Once that is crossed, you don’t earn any more points for that month.

Note that transactions such as loan EMI payments, fuel payments, wallet and prepaid card loading, etc., will not fetch you any reward points.

Finally, the card also gives complementary access to airport lounges and golf courses, among other things.

Talking about the likely intent behind the card, Ajay Awtaney, editor, LifeFromALounge.com, said, “I think Marriott hopes that more people will enter the Marriott ecosystem with this card. There are many people who shop around for hotel deals on MakeMyTrip and other OTAs (online travel aggregators). They are not brand loyalists. But once they sign up for this card, they will start looking at the Marriott brand in their wallet every day and once they start generating Marriott Bonvoy points, over time, Marriott hopes their hotels will become the preferred option.”

Also read: Reeling under huge credit card debt? Here’s how balance transfer helps

What works, what doesn’t

Awtaney feels the card has something for customers at both ends of the spectrum. At the lower end, it offers a free one-night stay that will at the minimum recoup the annual fee, and at the other end, for someone who is a frequent guest of Marriott hotels, there’s now an opportunity to earn 8 points for every Rs 150 spent at these properties.

So does this make the card a good enough deal? And how does it compare with others?

According to Awtaney, this is the first co-branded hotel card in India and it is not fair to compare it with other proprietary (non- co-branded) credit cards. About the earn rate, he said that the high rewards per Rs 150 of spending is “pretty good. But I don’t find it that great for other normal spends. For that, there are perhaps other better cards.”

Should you go for it?

Ashwin offers a different view point. He says, “Based on my experience over the past many years, I would value a Marriott Bonvoy point at 60 paisa. This is a conservative estimate. So it does not make sense to spend on this card as the earn rate (8 points for every Rs 150 spent) will not help you collect enough points even when spending at a Marriott hotel.” He added, “But it makes sense to have this card without spending on it except for what is the minimum required. For Rs 3,000 plus taxes per year, you get three benefits—one free night’s stay, Silver Elite Status and 10 ENCs.”

Ashwin suggests the American Express Platinum Travel Credit Card and Axis Bank Atlas Credit Card as alternatives since they have a better earnings rate. Unlike the Marriott Bonvoy HDFC Bank card, the points from these cards can be redeemed at other hotel loyalty programmes, too. Not just that, they can also be used for booking flight award tickets (those that can be paid for with air miles). The two cards charge an annual renewal fee of Rs 5,000 plus taxes.

Also read: The charges lurking in your credit card you didn’t know about

For example, the Axis Bank Atlas credit card offers five EDGE miles (Axis Bank’s reward points) for every Rs 100 of eligible travel (directly at hotel or airline website/app) spend. Each EDGE mile in turn can be converted into 2 hotel/airline partner points except for in the case of Marriott Bonvoy (where it is 2 EDGE miles into 1 hotel point). So, spending Rs 600 on the Axis Bank card can get you 60 (5 X 6 X 2) hotel/airline partner points or, 30 points in the case of Marriott Bonvoy. The same Rs 600 spent on the Marriott Bonvoy HDFC Bank card will get you 32 points (at 8 points per Rs 150 spent).

Then again, compared to the Marriott Bonvoy HDFC Bank card, the American Express Platinum Travel card gives you milestone benefits (additional privileges) at lower spending thresholds. For instance, on a spend of Rs 4 lakh on the American Express card, you get 48,000 points that are converted into Marriott Bonvoy points (1:1 ratio) plus a Taj Experiences e-gift card worth Rs 10,000. For the Marriott Bonvoy HDFC Bank card, the milestone benefit of one free night (this is in addition to the one free night that you get on sign up and renewal every year) award kicks in only after you spend Rs 6 lakh.

So, unless you are a Marriott hotel loyalist, you can get a better deal with other travel credit cards.

That apart, Ashwin makes another point on acceptability. The Marriott Bonvoy HDFC Bank card is being issued on the Diners Club card network. “Visa and MasterCard networks have better acceptance globally. So some merchants in smaller cities/towns may not accept this card,” said Ashwin. A question sent to HDFC Bank on this remained unanswered. The article will be updated once we receive a reply from the bank.

Finally, if you do decide to go for the card, what matters is whether the bank will issue you the card. Credit card experts we spoke with had reservations on whether an existing HDFC Bank credit card customer (already holding two credit cards) may be eligible for yet another credit card from the bank. We asked HDFC Bank whether someone with 1 or 2 HDFC Bank credit cards will be issued the Marriott Bonvoy HDFC Credit card, in addition. Here is what the bank said - "Yes, the Marriott Bonvoy HDFC Bank Credit Card will be provided to existing credit card holders of the bank subject to the customer’s profile."

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!