Highlights

The strong growth continues in Q1

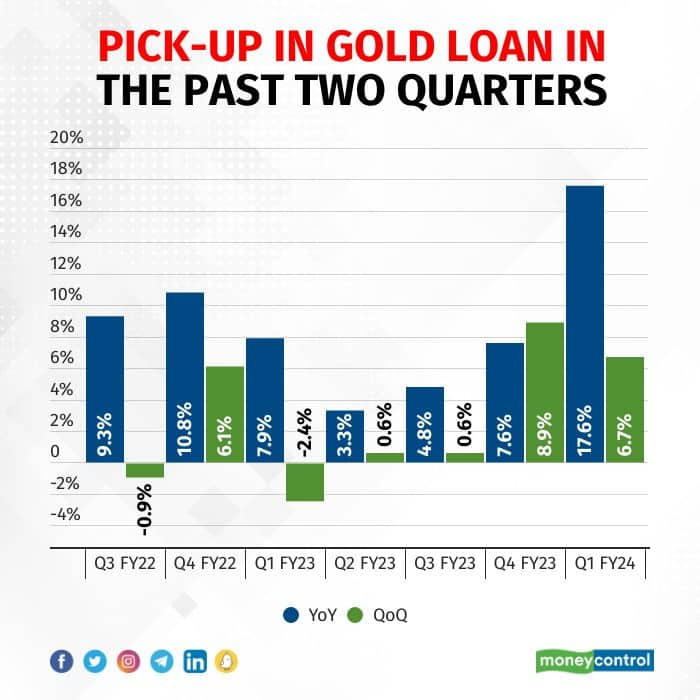

Muthoot Finance saw over 21 percent overall loan growth year on year (YoY) with close to 18 percent growth in gold loans and over 35 percent growth in non-gold, driven mainly by a 49 percent growth in microfinance and a stupendous growth in the vehicle finance business on a smaller base.

Source: Company

Source: Company

The company attributed this turnaround to focused campaign, a pick-up in economic activity that requires higher liquidity, and firm gold prices that increases borrowing capacity with the same pledged gold.

Source: Company

However not all is well

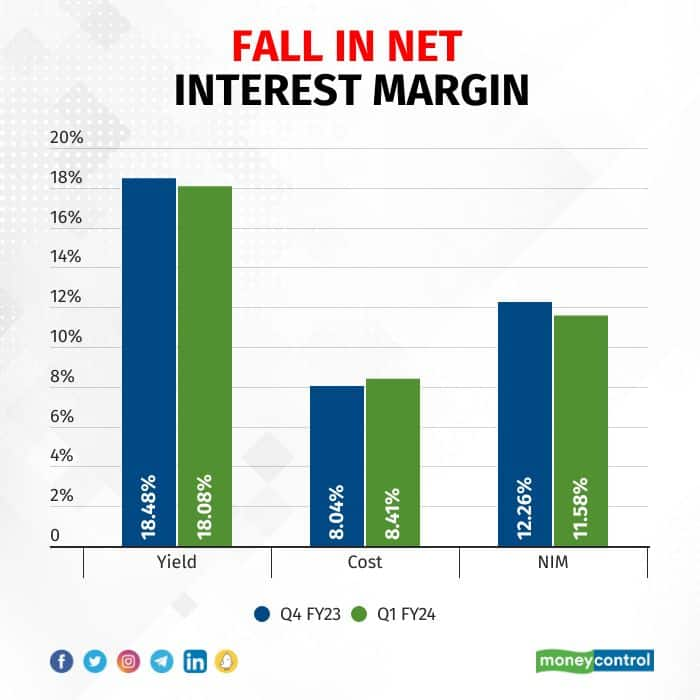

The company saw a sequential decline in lending yields and an increase in borrowing cost, resulting in a compression in the net interest margin. The gold loan disbursement in the quarter was strong. However, we do not see competitive intensity waning in gold loans although gold loan is a high operating expense business and not easy to manage. Banks now have the reach (tie-ups with fintechs and smaller NBFCs) and also have a significant cost-of-funds advantage. For banks, this is a no-risk (underlying asset that can be easily monetised), relatively high-yielding product that can support their interest margins. We believe, Muthoot will see incremental dilution in interest margin even if it tries to achieve low double-digit growth.

Source: Company

Source: Company

While we do recognise that gold lending is completely secured, the spike in reported Stage 3 assets cannot be ignored. The reported Stage 3 assets soared to 4.26 percent in the last reported quarter from 2.13 percent in the year-ago period. With a loan-to-value of 60 percent, the principal and overdue interest is covered. Hence, Muthoot prefers to give time to struggling borrowers rather than auction the jewellery immediately. While this is a great strategy to gain loyalty, the spike in bad assets points to incrementally deteriorating borrower profile.

Diversification to non-gold

Muthoot’s management is acknowledging the rise in competitive intensity and is pushing the pedal on diversification. So far, non-gold is 12 percent of total assets and 6-7 percent of consolidated profit. Taking them to a meaningful size is not going to happen in a hurry.

The company, nevertheless, has ambitious plans. In the MFI entity Belstar (Muthoot’s stake at 59.02 percent), the target is to ramp up assets to Rs 9000 crore by the end of the fiscal from the current Rs 7000 crore. In the home-finance business, the company intends to have an asset base of Rs 1800-1900 crore by the year end, from the current Rs 1500 crore.

The company has also entered other high-yield segments to compensate for the growth challenges in gold finance. These include unsecured small business loans and micro personal loans, to be disbursed digitally.

While diversification is imperative, given the challenges in the core gold loan business, pressing the growth pedal in non-gold may also run the risk of not so proper credit underwriting. Unlike gold, the bulk of the non-gold business is unsecured and vulnerable to any downturn.

Outlook

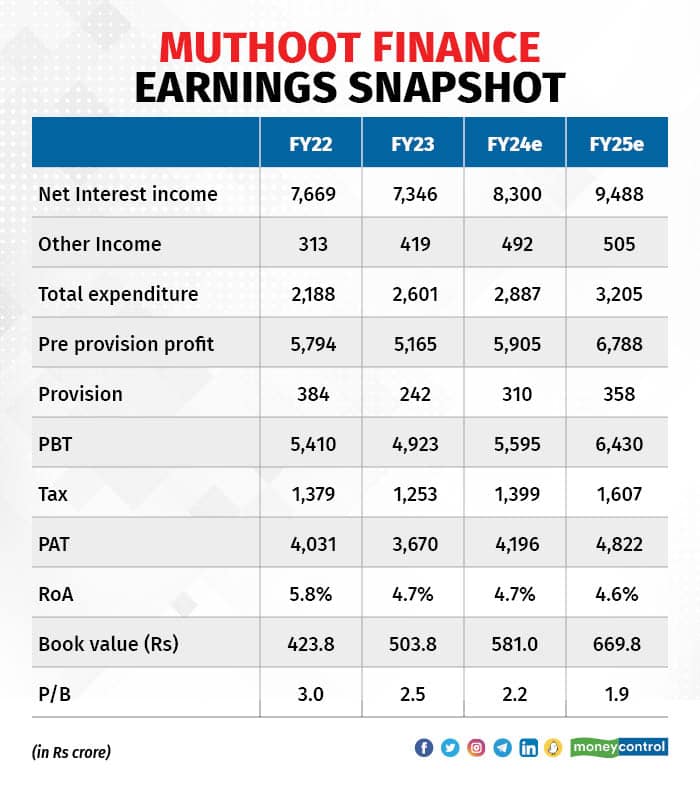

Muthoot is well-capitalised (CAR at 30 percent) and has access to diversified sources of funding. It is, therefore, at a relative advantage to smaller NBFCs. However, we do not expect a meaningful bounce-back in margin should growth remain strong. The higher share of non-gold could result in an increase in structural credit cost as well. Hence growth may resume, but with lower return ratios and a modest earnings trajectory. We expect the stock performance to mimic earnings growth and rule out multiple re-rating. We therefore rate Muthoot Finance as a Market Performer.

Source: Company, Moneycontrol Research

Source: Company, Moneycontrol Research

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | DPI, UPI, AI and finding a tech Neverland

Sep 8, 2023 / 02:38 PM IST

In this edition of Moneycontrol Pro Panorama: China's dam in Tibet proves costly for India, cries about AI safety gains momentum, ...

Read Now

Moneycontrol Pro Weekender: The road to 2047

Aug 12, 2023 / 10:56 AM IST

According to an RBI study, we need to grow real GDP by 7.6 percent per annum to be a developed economy. And that target is eminent...

Read Now