To get the most out of your National Pension System (NPS), it is not just important to invest regularly but also to make the right decision regarding pension payouts after you turn 60.

Under NPS, at the age of 60, you get to withdraw up to 60 percent of your corpus – built through regular investments – as a lump-sum, tax-free amount. The remaining 40 percent has to be mandatorily used to purchase annuities from any of the 15 registered annuity service providers (ASP) (life insurance companies including Life Insurance Corporation of India, SBI Life, ICICI Prudential Life and HDFC Life). This will be used to pay you pension for a lifetime. To be sure, this pension income is taxable at the slab rate applicable to you.

Besides choosing the ASP, you also need to pick the annuity payout option that suits you and your family the best. If your capital – or amount used to purchase annuities – is at least Rs 10 lakh, out of which you use at least Rs 5 lakh for each option, you can choose more than one annuity payout mode.

Annuity for life (lifetime pension without return of capital)

If you select this option, you will receive your pension, but it offers no return of capital on the death of the pensioner. So, the spouse or heirs will not receive any benefits upon the pensioner's death.

This policy is best suited for pensioners who do not have dependents, that is, the spouse and children are financially secure and do not need this additional source of income.

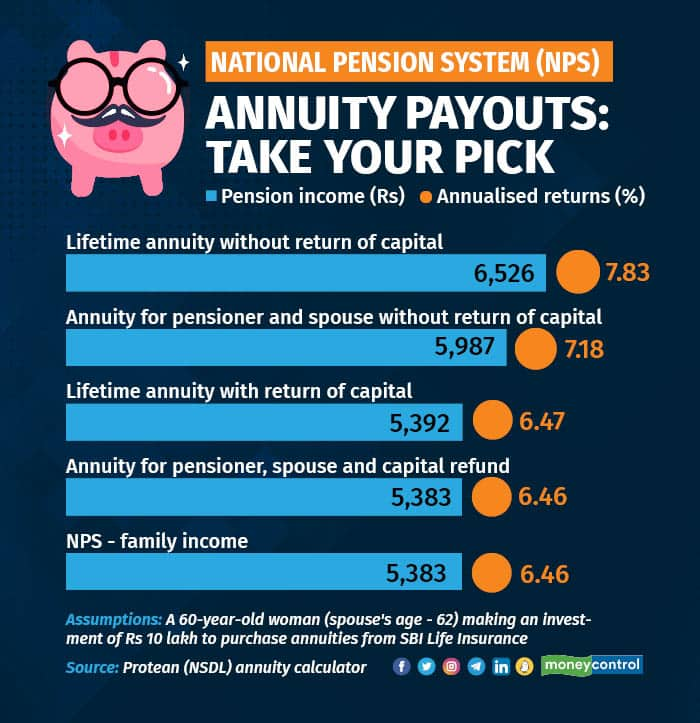

For instance, if you are a 60-year-old woman (spouse 62 years), SBI Life Insurance is your ASP, and your initial investment (or purchase price for buying immediate annuities) is Rs 10 lakh, you will receive monthly payouts of Rs 6,526 (7.83 percent return currently) under this option.

"Before choosing between options at retirement, ascertain your financial and health conditions. If your inflows are not sufficient to sustain day-to-day expenses, you can consider an annuity for life without a return of corpus, as the pension will be higher. On the other hand, if you have enough, then you can settle for a lower pension and leave behind a substantial amount (initial investment or purchase price) for your wife and kids," says Kuldip Kumar, Partner, Mainstay Tax Advisors.

Annuity for life with 100% payable to spouse upon pensioner’s death

The annuity will be paid as long as either of the two pensioners – primary pensioner or the spouse – are alive. If the primary pensioner dies, the spouse will receive 100 percent of the original pension throughout life. However, once the spouse, too, passes away, the children will not be entitled to any proceeds. Again, this option will sit well with couples whose children are well-settled and do not need this income. If your ASP is SBI Life Insurance, you will receive Rs 5,987 (7.18 percent return at present) every month, assuming the same parameters mentioned in the earlier example.

Annuity for life with return of purchase (RoP) price

Unlike an annuity for life’, the purchase price – the lump-sum amount you used to purchase annuities at the outset – will be paid out to the nominee. So, you can take this route if you want to earn pension income throughout your life and yet wish to leave behind a pot of money for your spouse or children. As per Pension Fund Regulatory and Development Authority of India (PFRDA) data, 70 percent NPS subscribers have chosen this option.

The flipside: Your pension payout will be lower compared to the simple annuity for life option. Taking the example of SBI Life Insurance as your ASP and other parameters mentioned earlier, your monthly pension will be lower at Rs 5,392 (6.47 percent return) if you pick this option.

"Pension payments are bound to be lower when compared to annuity without return of capital. Another drawback is that the nominees may not need the after the annuitant's death. Ultimately, the decision on whether to choose an annuity for life with capital refund or an annuity without return of capital will depend on the individual's circumstances and financial goals," says financial advisor Viral Bhatt, Founder, Money Mantra.

Annuity for life with 100 percent payable to spouse on death of annuitant, with RoP

This option is next only to annuity for life with return of purchase price (capital) option. Here, the pension will be paid out until either of the annuitants is alive. Once the primary pensioner dies, the secondary annuitant – the spouse – will receive 100 percent of the original annuity throughout life. Once the spouse too dies, the purchase price – that is, the initial investment amount – will be handed out to the couple’s nominees.

If you wish to pass on your retirement corpus to your children, this option will fit your needs. However, as mentioned earlier, any return of capital will mean a lower pension payout during the pensioner’s lifetime.

For instance, SBI Life Insurance’s pension payout under this option will be lower at Rs 5,383 (6.46 percent) per month for those choosing this option. So, ensure that you are comfortable with the idea of making compromises on your lifestyle during the period.

NPS – family income

Under this option, the subscriber (that is, the annuitant) will receive pension payouts throughout life. On the death of the annuitant, the spouse will be entitled to the annuity. In the case of her/his death, the pension will be paid to the subscriber's mother and, after her, to the father.

On the death of the last survivor, the purchase price would be refunded to the annuitant's child or nominees. However, again, you will have to settle for a lower pension during your lifetime. In this case, too, SBI Life’s monthly pension payout will be Rs 5,383 (6.46 percent).

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!