Highlights

The performance of life Insurance companies has been lacklustre in this fiscal so far. The new tax regime, effective from April 1, 2023, has obvious implications and led to subdued performance in the initial phase of FY24. Most life insurers are making strategic adjustments in their product portfolio to revive growth. While the transition will lead to some uncertainty in business growth and financials, the underlying structural growth story of the life insurance sector remains convincing. This makes an investment case for life insurance companies. But which stock investors should consider?

The three listed private life insurance companies — SBI Life, ICICI Prudential Life, and HDFC Life — along with LIC command more than 80 percent of the market share in the life insurance industry in terms of first year premium (as of July end). Given the under-penetrated market, the share of the big four in the pie would only grow over time as the size of the pie (overall industry) gets bigger, though the entry of Jio Financial can pose some competitive risk. As per media reports, Jio Financial plans to enter life as well as general insurance business and will soon apply for insurance licences. It has set aside Rs 1,000 crore capital for each business.

LIC’s stock has underperformed since listing in March’22. The insurance behemoth has many strengths and has reported huge profits but lags in terms of business growth and margins. Read: LIC profit soars, but business growth, margins stay lacklustre

Talking about private life players, there is a lot in common in the business models of the three top private life insurers. For instance, the margin of SBI Life, ICICI Pru, and HDFC Life are almost the same and have improved over the past few years. But their key business strengths are distinct and so have been business growths. Moreover, the valuation that the Street assigns to these stocks is different. Let’s look into some of the key parameters to identify the long-term compounder.

Business growth – HDFC Life is leading among private players

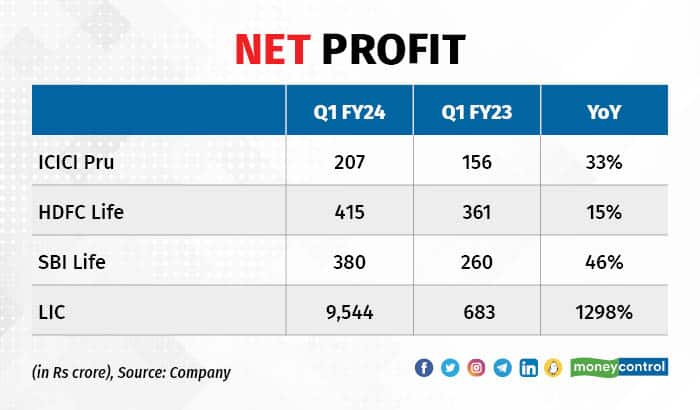

While the private life insurers reported good profit growth in the first quarter of FY24 (Q1 FY24), net profit is not the right yardstick to assess life insurance companies.

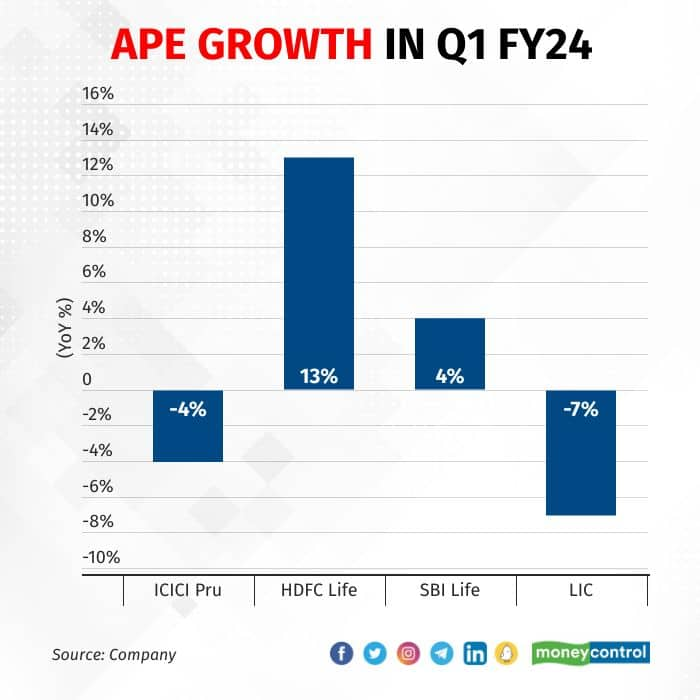

Insurers are compared on top-line growth, which is the total annualised premium equivalent (APE), a measure to ascertain business sales in the life insurance industry.

.

.

Among the private life insurers, ICICI Pru has been lagging in terms of business growth since many quarters as it has been rebalancing its product portfolio and diversifying its distribution channels.

SBI Life’s growth was pulled down as individual non-par savings APE contracted 29 percent year on year (YoY) since last year’s base was particularly high. Most other segments showed reasonably healthy growth.

HDFC Life’s growth in Q1 FY24 clearly stood out driven by ULIP, annuity, and term (protection) products.

.

.

Margins seems to have peaked

Over the last couple of years, for all the three players, there has been a clear move to rebalance the product mix towards a higher share of protection (pure term insurance). HDFC Life had a first mover advantage in protection, especially group protection business. But competitors soon realised the growth potential of this segment and the relatively high margin it can fetch.

Consequently, all private players have been aggressive in growing the protection business. So much is the focus on improving the product mix that ICICI Pru gave up growth in other areas of business for the “protection” cause. ICICI Pru’s ULIP sales almost stagnated in FY19 and FY20.

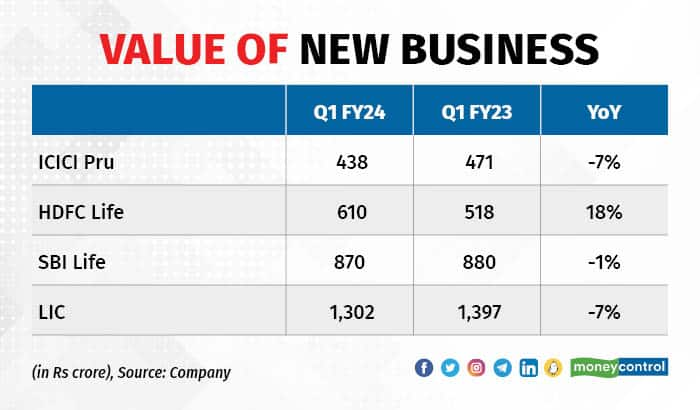

The focus on selling protection has been successful and has enabled aggressive VNB (value of new business) growth for private players and improved the VNB margins in the past few years.

.

.

ICICI Pru’s VNB margin has tripled since FY17 from around 10 percent to 30 percent of the APE in Q1 FY24, thanks to its razor-sharp focus. While ICICI Pru has done exceptionally well by doubling its VNB in the past four years and have seen significant margin expansion, all three private players are almost on a par in terms of VNB margins now.

Further improvement from here seems a tall task.

LIC, of course, lags with VNB margin at 14 percent, half of what is generated by private peers, and has significant scope of improvement.

Distribution strength — SBI Life is invincible leader

SBI Life is the clear leader among the big three in terms of distribution scale, with a network consisting of more than 25,000 branches of its parent SBI. Apart from being huge, the banca channel is under-leveraged as SBI’s insurance cross-sale per branch will be about 50 percent lower than ICICI Bank or HDFC Bank. This indicates a strong growth potential for SBI Life if the cross-sale efficiency of the bank improves.

While bancassurance is a moat, for ICICI Pru it has turned out to be a weakness. One of the key reasons for the decline in the top line of ICICI Pru is the weak performance of its bancassurance partner ICICI Bank. The share of ICICI Bank in ICICI Pru’s total APE is down to 13.9 percent in Q1 FY24 from 51 percent in FY19. While the diversification of the distribution channel is welcome, business growth has suffered for long. ICICI Pru needs to fix its bancassurance channel strategy.

HDFC Life is now the subsidiary of HDFC Bank and can expect some acceleration in sales through the bancassurance channel.

While the banca channel doesn’t seem to a key differentiating factor prima facie since peers (HDFC Life and ICICI Pru) also have a similar strong backing, SBI Life’s distribution strength gets truly reflected in its commission costs.

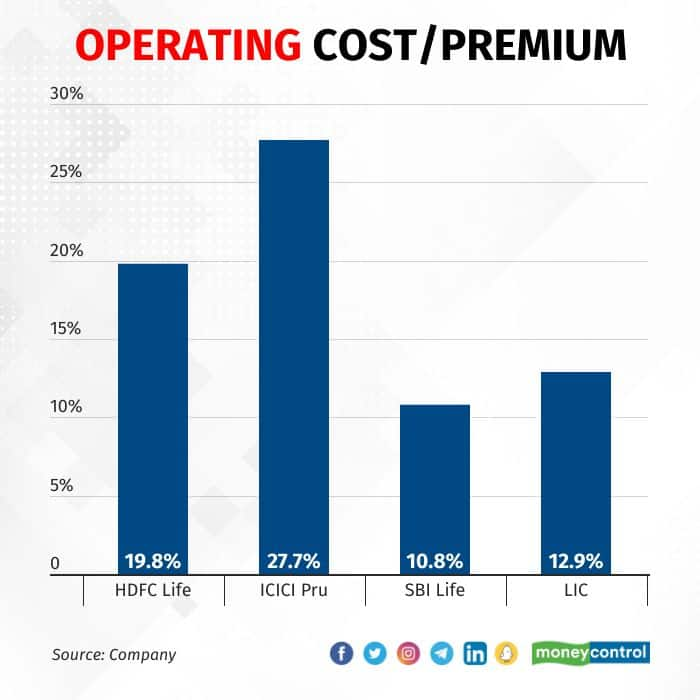

SBI Life has cost leadership with the total cost ratio at 10 percent of the gross written premium in Q1 FY24 compared to the ratio of above 15 percent for peers.

Valuation and view

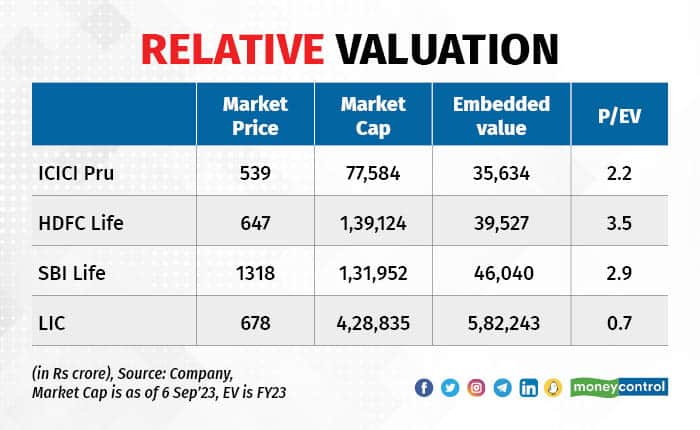

HDFC Life has the most well-balanced product mix and diversified distribution channel. HDFC Life has proven itself over several years now and its premium valuations in the insurance space seem well justified. However, the expensive valuation leaves little room for more upside in the share price.

ICICI Pru’s focus on growing VNB is understandable as it ultimately determines the value created for equity shareholders, but the lack of growth is an area of concern. Despite the management’s conviction that this is a temporary/transient phase and what matters is VNB, the market seems to have doubts. This is reflected in the low valuation of ICICI Pru compared to peers. ICICI Pru must now push the growth pedal as the Street expects to see business growth along with high margins and the stock re-rating would be contingent on the same.

SBI Life, with the backing of its parent, has access to distribution scale, which is hard to contest, even by the other two big players — ICICI Pru and HDFC Life. Bancassurance is the single biggest moat in the life insurance business and SBI Life leads the pack among the big three. It can deliver some serious growth on the back of its channel strength. SBI Life is also a master of efficiency, again driven by lower commissions and overheads on banca sales. Combine all these fundamental strengths with a very reasonable valuation metrics and we have a potential long-term compounder in the form of SBI Life.

While there are no triggers in the near term, long-term investors looking to participate in insurance growth story should buy SBI Life’s stock on dips.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | DPI, UPI, AI and finding a tech Neverland

Sep 8, 2023 / 02:38 PM IST

In this edition of Moneycontrol Pro Panorama: China's dam in Tibet proves costly for India, cries about AI safety gains momentum, ...

Read Now

Moneycontrol Pro Weekender: The road to 2047

Aug 12, 2023 / 10:56 AM IST

According to an RBI study, we need to grow real GDP by 7.6 percent per annum to be a developed economy. And that target is eminent...

Read Now