Credit card defaults in India have gone up with a rise in card usage.

According to the Reserve Bank of India (RBI), credit card default rose to Rs 4,072 crore, or 1.94 per cent, at the end of March 2023 compared to the previous year, while credit card outstanding rose to Rs 2.10 lakh crore in March 2023 from Rs 1.64 lakh crore in March 2022.

If you are also running a high credit card debt, one alternative to reducing your debt is the balance transfer method. Here’s how it works and whether you should opt for it.

What is a credit card balance transfer?

A credit card balance transfer means that you transfer your outstanding credit card debt to another credit card where the interest rate is lower. Balance transfers can be done between different banks, not within the same bank. The balance transfer method to reduce your credit card debt can come in handy since interest rates on outstanding card debt can go up to 42 percent.

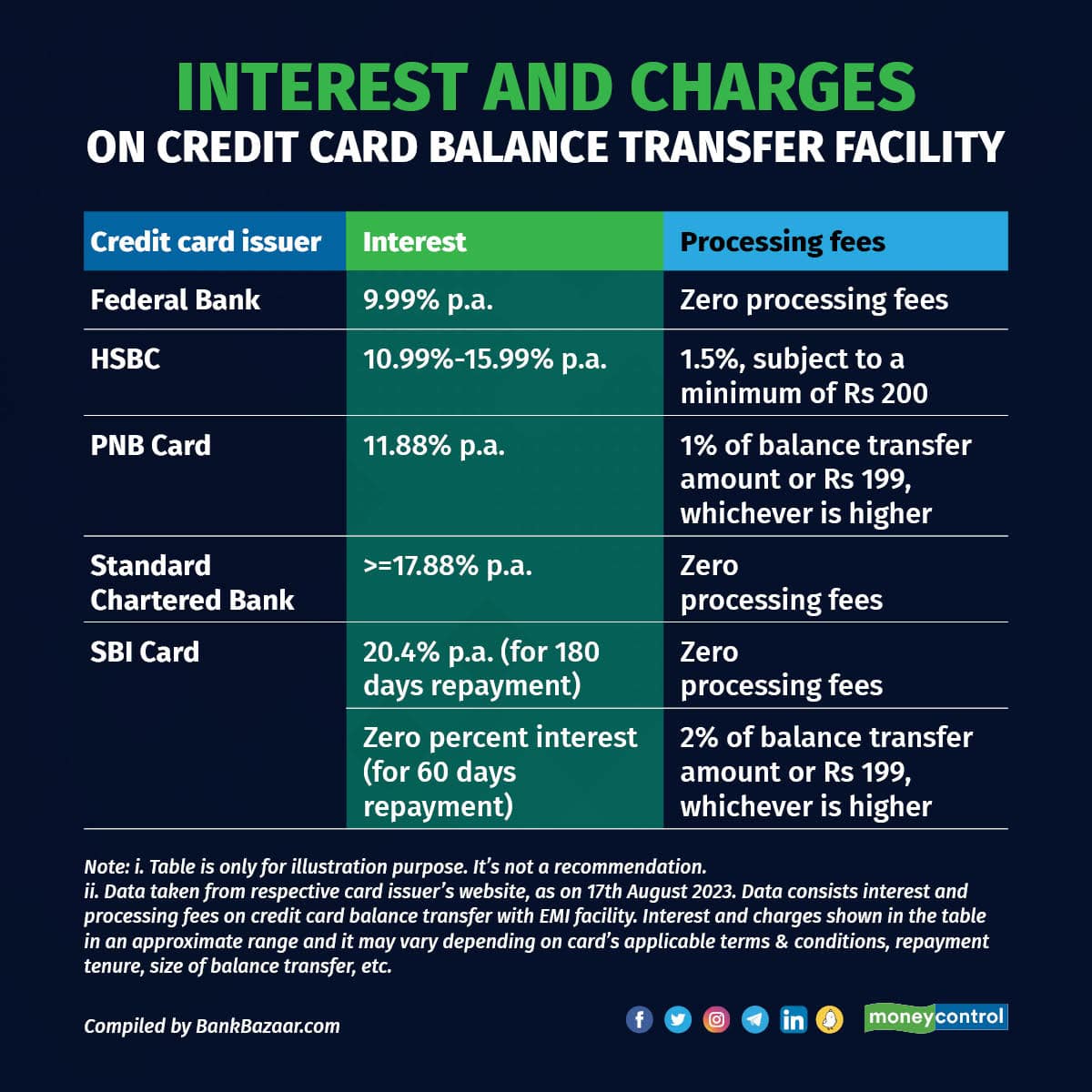

All banks do not allow you to transfer the balance. Among those that do offer this are Federal Bank, HSBC, PNB Card, Standard Chartered Bank, HDFC Bank, SBI Card, Axis Bank, etc.

Parijat Garg, a digital lending consultant, said, “Banks now offer variant plans in the balance transfer. You can choose the plan that suits you the most.” For instance, banks offer plans where the payment is due within 30-45 days and interest costs are zero. Then, there are plans with EMI balance transfer, where dues are repaid as 3-6 months EMI as opted while applying for the transfer.

Garg added that if you have an outstanding debt of anything less than Rs 10,000, then the EMI option may not be available from the banks.

Usually, the existing bank would offer "EMI on credit cards" to its good customers, allow them to pay a large expense over a period and would want to retain the customers. Whereas, the other bank (in balance transfer) would want to attract more balance towards it and may offer an attractive proposition such as a low-cost transfer, and also give an EMI option.

“Now the best customers usually get the best offers from the existing bank itself, so may not use the balance transfer,” Garg said. He, however, added each bank has its own policy for identifying good and near-good customers. That is where more opportunities lie for other banks to attract customers. Such a bank would be one which has more growth aspirations.

Adhil Shetty, CEO of BankBazaar.com, said, “While transferring the balance to a new card, the existing card issuer will try to retain you, usually by offering you alternative repayment terms.” It may be a better option as it allows you to retain an old line of credit, which is a good thing for your credit score.

Also read | 6 easy steps to become debt-free

Check your APR and then decide

If you have credit card debt on a card with a high annual percentage rate (APR), then transferring the balance to a card with a lower or zero introductory APR can help you save on interest payments.

The interest rate that reflects the yearly cost of the interest on your outstanding balance is called the annual percentage rate. This rate is charged to the cardholder on the amounts carried forward beyond the due date for the payment of balances.

“If you have balances on multiple high-interest credit cards, consolidating these balances onto a single card with a lower interest rate can make managing your debt simpler,” Shetty said. Many credit cards offer promotional periods with zero or low APR on balance transfers for a certain period, often ranging from 6 to 18 months. For instance, SBI Card offers balance transfer at zero percent interest if repayment is within 60 days and it also offers balance transfer at 20.4 percent annual interest if repayment opted is for 180 days (refer to graphic).

Shetty added, “You should have a plan in place to pay off the transferred balance before the promotional period ends or be prepared to handle the debt at the regular interest rate. If you can pay off the balance within the promotional period, you can save significantly on interest.”

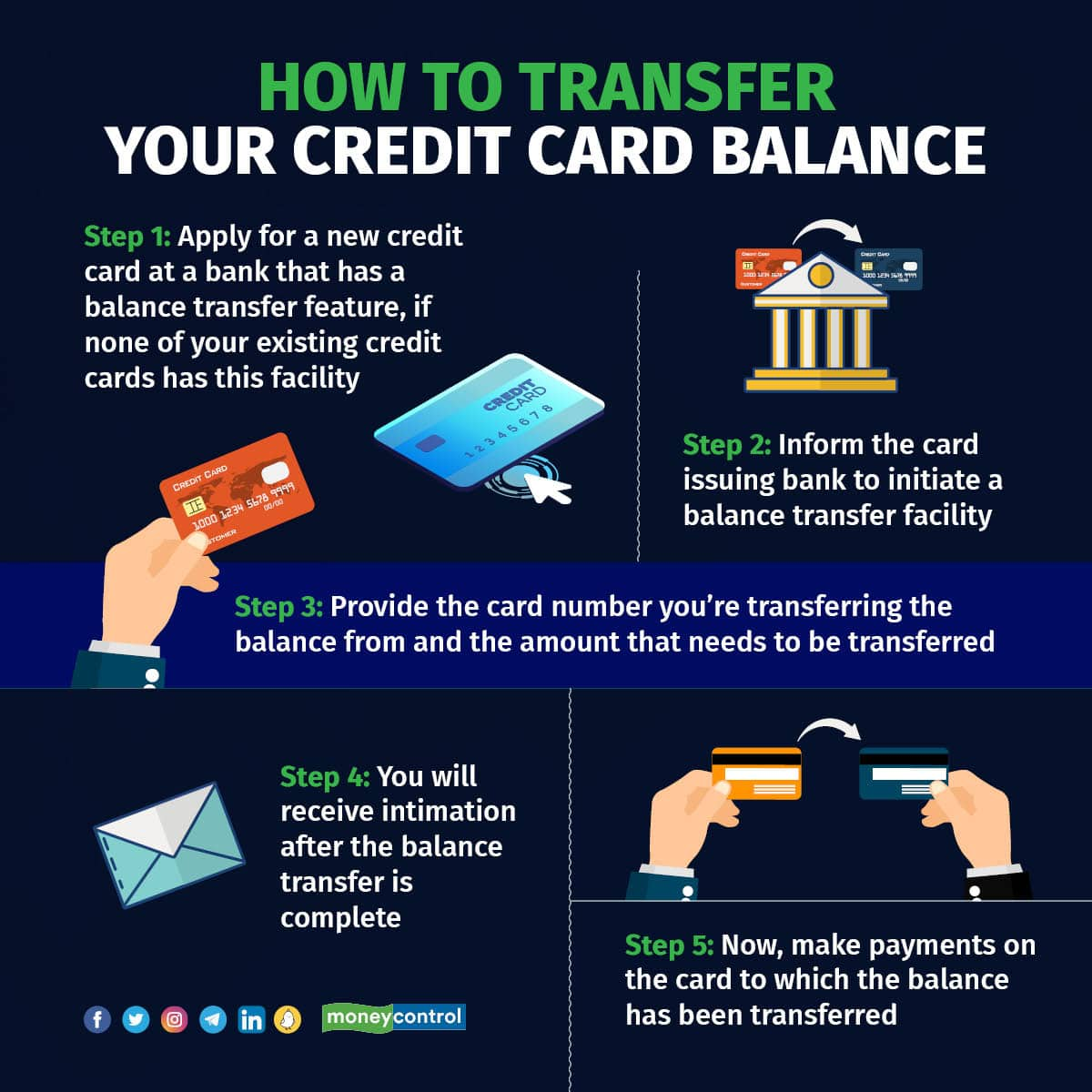

How to transfer a balance from one credit card to another?

Transfer of credit card balance makes sense only when the bank that you are transferring your balance offers rates that are more lucrative than the original credit card on which you have pending dues.

The most important point to note about credit card balance transfer is that you can transfer only that amount to your new credit card, which is within its credit limit. For instance, if your second credit card has a limit of Rs 1.5 lakh and your pending dues from your previous credit card are Rs 2 lakh, then only Rs 1.5 lakh can be transferred to the new credit card under the balance transfer scheme.

You will need to agree to the terms and furnish the following information and documents while applying for credit card balance transfer, i.e., your credit limit, expiry date of the credit card, outstanding credit amount and a credit card number, last 3-6 credit card bill statements, address proof, photocopy of credit card, etc.

The disbursement of funds for balance transfer is through the National Electronic Fund Transfer (NEFT) or a Demand Draft to the customer’s other bank credit card.

“The interest that you will pay now will be decided by your new credit card. It is crucial to pay off your credit to the new credit card issuer within the stipulated time in order to avoid hefty interest rates,” Shetty said.

Key points to remember while using a balance transfer

It's important to carefully read the terms and conditions of the balance transfer offer, including any fees associated with the transfer, the duration of the promotional period, and the regular APR that will apply after the promotion ends. “Additionally, be aware that opening a new credit card for a balance transfer can have a temporary impact on your credit score,” said Shetty.

Make sure to compare offers from different credit card issuers, calculate potential savings, and determine if the move aligns with your financial goals and ability to manage the debt responsibly, he added. If you're unsure, consider seeking advice from a credit counsellor.

“Credit counsellors work with credit card users and banks to chart out a repayment plan so that individuals can clear their outstanding dues and start off on a clean slate. The aim is to repay, not seek a pardon from debt,” Ritesh Srivastava, CEO of FREED, said.

Garg pointed out, “One should not wait for the last day to initiate balance transfer.” He suggested keeping at least 4-5 days period before the due date. If the balance transfer money gets credited after the due date, then the bank may charge penalty as due, which would have to be borne by the cardholder.

Also read | Using credit card reward points for domestic travel: A guide

Should you opt for a balance transfer?

You should avoid frequent balance transfers. “By frequently leveraging credit card balance transfers, credit scores may drop, and balance transfer costs may accumulate over time, diminishing savings from interest rate reduction,” Mahesh Shukla, CEO & Co-Founder, PayMe, a digital lending firm, said.

Shetty of BankBazaar.com advocates balance transfer only for those who promise financial discipline from here on. “Transferring a balance from one credit card to another can be a strategic move if you are looking to manage your credit card debt more effectively and potentially to save on interest payments,” he said. Moreover, as Shetty said, this is a tactical strategy. Put in another way, a credit card balance transfer should be part of an overall debt management strategy.

“Keep in mind that there might be fees associated with balance transfers, so it's important to carefully read the terms and conditions of the card that offer this,” Raj Khosla, MD, MyMoneyMantra.com said.

Credit card holders need to have a good track record regarding their credit card spends, transaction patterns and payment history in the credit report to become eligible for a balance transfer on the credit card. The terms and policies vary depending on the internal policies of a bank.

For instance, at ICICI Bank, having a minimum outstanding of Rs 15,000 on the other bank credit card is a pre-requisite for availing a balance transfer facility. SBI Card processes balance transfer subject to a minimum order amount of Rs 5,000 and a maximum order amount of 75 percent of the available credit limit on the assigned SBI Card account.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!