A life insurance cover (term plan) is a must-have for ensuring that your family is financially protected in the event of your demise.

But apart from having a term plan (base cover), you can also opt for a rider — an additional feature on top of the base cover — to make your life insurance more comprehensive.

Now, certain riders such as the critical illness rider come at significant cost and therefore, require a cost-benefit analysis before you opt for them. However, an accidental death benefit (ADB) rider is a relatively low-cost option that gives you additional protection.

“An accidental death benefit rider is easy to purchase. It does not require any elaborate documents or formalities. You just have to fill out an application form,” says Sanjay Arora, Executive Vice President and Head of Operations, Tata AIA Life Insurance. After all, unlike critical illnesses, there are no disclosures to be made regarding any pre-existing diseases.

While some companies sell accidental death and disability covers in the form of a single rider, others offer these separately. Affordability permitting, it is best to buy a combined accidental death and disability benefit (ADDB) rider. An ADDB rider offers compensation for loss of income due to total and permanent disability caused by an accident, while a simple ADB rider pays out the claim amount only in case of death.

Also read: Moneycontrol-SecureNow Health Insurance Ratings: Your guide to picking the right health policy

How it works

Like any rider, the ADB rider too can be taken only on top of a base plan, say a term plan. This easy-to-understand rider gives the policyholder’s nominee an additional pay-out (besides the sum assured under the base plan) if the policyholder dies due to an accident.

If the death is caused due to reasons other than an accident, then the insurer pays out only the sum assured under the base plan. That is, the rider provides additional financial protection in case of an accident-related death.

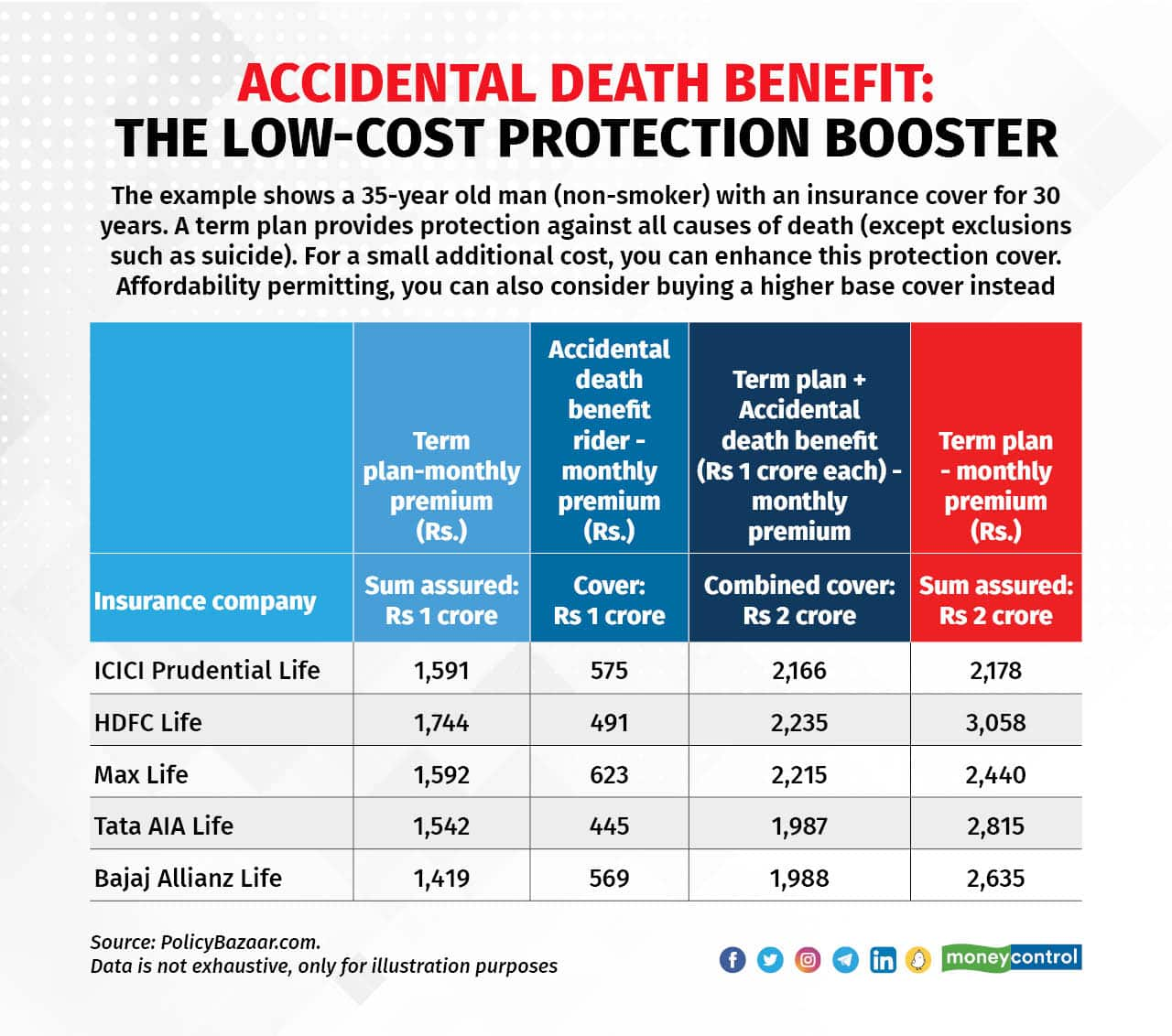

Let’s say, you have a term plan with a base cover of Rs 1 crore and an ADB rider of Rs 1 crore. Then, in case of accidental death, the policyholder’s nominee will be paid Rs 2 crore, and in case of death due to other reasons, the pay-out will be Rs 1 crore.

Also read: Should you buy a single premium life insurance cover?

Professor Manoj K Pandey, a faculty member at Birla Institute of Management Technology and a life insurance industry veteran, points out that one can take an ADB rider not only with a term insurance plan but also with a host of ULIPs, endowment plans etc.

ADB rider cannot exceed base coverage

So, what is ‘accidental death’ and how much cover can you take under this rider? Deaths due to car or other road accidents, airplane crashes, injuries from a fall, fire or firearm accidents qualify as accidental death under this rider. However, deaths due to suicide or self-inflicted injuries, parachuting, engaging in hazardous sports, etc., are excluded.

Your ADB rider amount cannot exceed your base plan cover. If you have a term plan with a base sum assured of Rs 1 crore, you can at best take an ADB cover of a crore.

But how much cover should you actually take? “An ADB rider comes at a very low additional premium, so you should take the maximum possible cover,” says Rhishabh Garg, Head, Term Insurance, Policybazaar.com.

Giving a rough estimate, he says, if you already have a term plan with a sum assured of Rs 1 crore, then the cost of an additional Rs 1 crore cover will be 80-90 percent of the first Rs 1 crore. But, with an ADB rider, the additional cost could be just 25-30 percent.

Of course, with the latter, you are covered only if the death is due to an accident.

Higher base cover or ADB rider

So, should you go for a higher base sum assured or an ADB rider? Here is what experts have to say.

“As the name suggests, the rider ‘rides’ on a base policy. The sum assured under the rider cannot exceed the sum assured of the base policy. Hence, one should take the maximum possible life insurance cover in the base policy. This (base policy) provides protection against death by any cause, be it due to an illness, old age or accident," says Pandey.

Accidental rider is like a top-up, to enhance the benefit should one die because of an accident. "This is the easiest rider to get with almost no underwriting attached to it, except for those with some deformity, etc. The premium is also very low,” he says.

Kapil Mehta, co-founder and CEO of SecureNow Insurance Brokers, offers a similar view. “Taking a higher sum assured under the base plan is the best option, if you can afford it. The accidental death benefit can be seen as a cost-effective way of increasing your sum assured,” says Mehta.

Garg suggests that while making this choice, it’s important to evaluate one’s lifestyle. “If you have heavy usage of two-wheelers or public transport such as shared autos, which expose your life to greater risk than, say, travelling by car, then you can consider taking this rider.” Do note, however, that the payout is not confined to vehicular accidents alone. Death due to a fall at home will also qualify as an accident.

While the ADB rider is no substitute for full-fledged life insurance, it is a good addition for enhanced protection, especially considering its lower cost and the ease of availing of it.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!