Highlights

Demand environment continues to remain robust and TMJL is confident of a healthy double-digit growth in the current fiscal. Demand has gained traction in the semi urban/rural areas, which form a key consumer segment for the company.

Favourable regulatory tailwinds, like mandatory hallmarking, provide significant scope for market share gains for organised players like TMJL in the long run. Also, margin improvement, owing to better product mix as well as operating leverage, provides robust earnings visibility.

Among the consumer discretionary segments in the organised space, the jewellery industry has been leading the growth momentum, given its perceived investment value as well as accelerated shift towards the organised space. TMJL is among the few listed jewellery players with a strong brand, a wide and loyal customer base, robust store operational metrices as well as return ratios.

The stock has had a stellar run of about 138 percent (adjusted for the ex-bonus share price) since our last note in January 2023, making it one of the best-performing stocks in the mid-cap space.

We retain our bullish view on the stock in the light of the strong earnings visibility. The recent announcement of bonus shares (1:1) will help to improve liquidity in the stock.

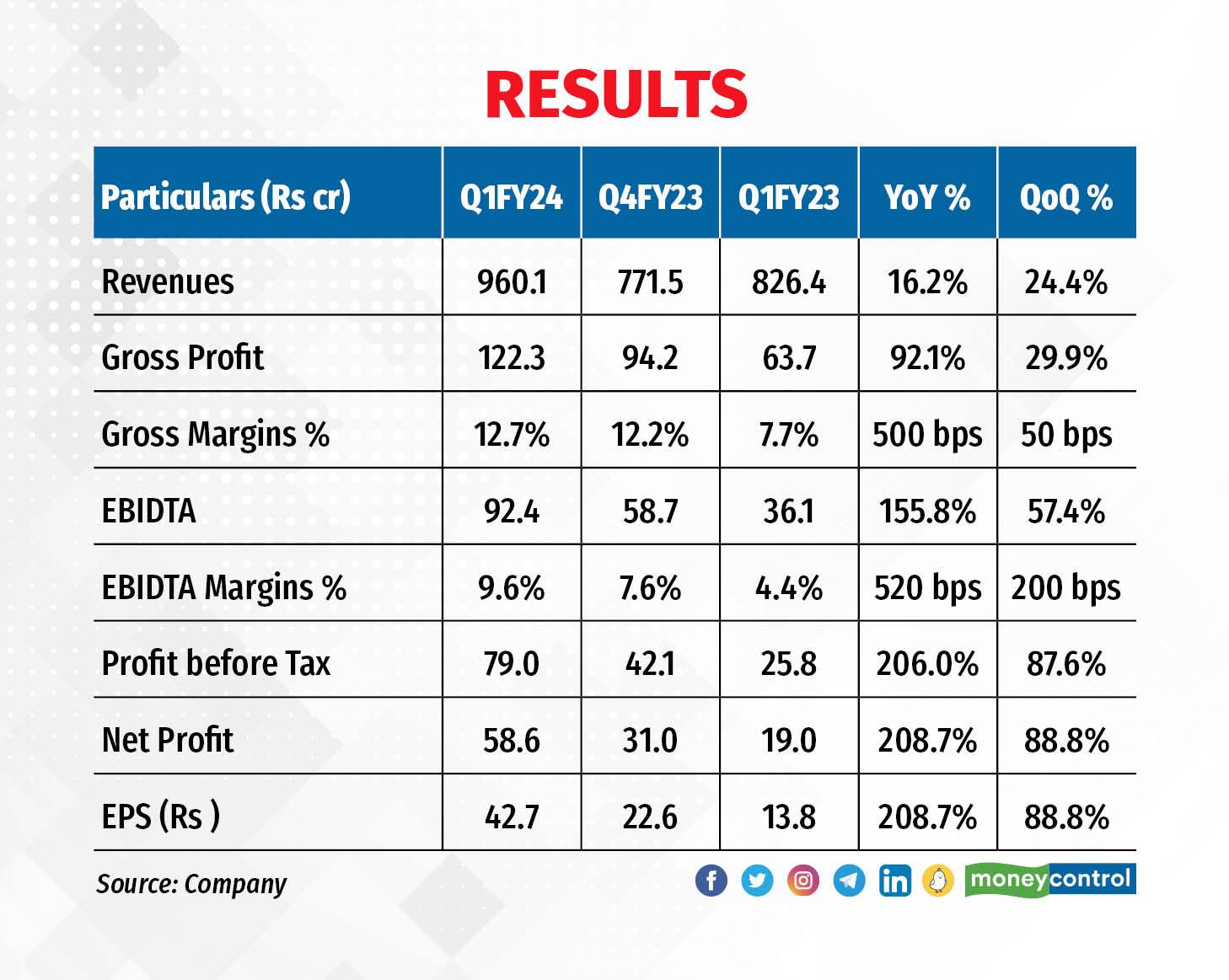

June 2023 performance

Revenues grew 16 percent year on year (YoY). Retail sales grew at a much higher rate of 27 percent YoY, owing to strong consumer demand. Despite a sharp volatility in gold prices, demand momentum was robust. Wholesale sales, however, dipped sharply 70 percent, owing to a high base of the corresponding period last year.

Gross margins improved sharply 500 bps, owing primarily to an inventory gain of Rs 32 crore due to a surge in gold prices. Also, a better product mix (increased share of non-gold jewellery) aided margin improvement. Operating leverage, thanks to a strong top-line growth, further boosted EBITDA margins. Net profit almost trebled on a YoY basis.

Demand environment strong; healthy store expansion on track

TMJL indicated that the demand momentum witnessed in Q1FY24 is expected to sustain. Consumer sentiments remain buoyant. Demand traction has been strong in Tier-2 and rural areas, which form the majority of TMJL’s customer base. The company expects healthy double-digit growth in the current fiscal.

TMJL would maintain a healthy store expansion. The company plans to open about five stores in the current fiscal (store count of 53 as of March 2023). It would continue to strengthen its presence in the state of Tamil Nadu and is looking to enter larger cities such as Chennai. Apart from the new stores, TMJL plans to renovate about 10 stores (with better stock-keeping capacity) to improve the overall consumer experience and enhance the business preposition.

Margin improvement to sustain

TMJL expects the margin improvement being witnessed over the past two quarters to sustain. The company has been working on improving the share of sales of high margin non-gold jewellery, like silver and diamond (currently accounts for about 9-10 percent of overall sales). Apart from better margins, TMJL would be able to attract a lot of new consumers by focusing more on non-gold business. Also, with operating leverage and focus on higher inventory turnover, TMJL would be able to improve the store operating metrices.

Continued market share gains for organised players

The jewellery industry is expected to continue to witness increased market shift from the unorganised to the organised segment. Mandatory hallmarking regulations (jewellery needs to be certified for purity), which is being implemented in phases pan-India, is expected to reduce the pricing differential between organised and unorganised segment. Also, consumers (particularly youth) are increasingly preferring branded products owing to the varied designs, leading to market share gains for organised players like TMJL.

According to industry estimates, the share of organised players is expected to increase from about 35 percent in FY22 to about 44 percent in FY26.

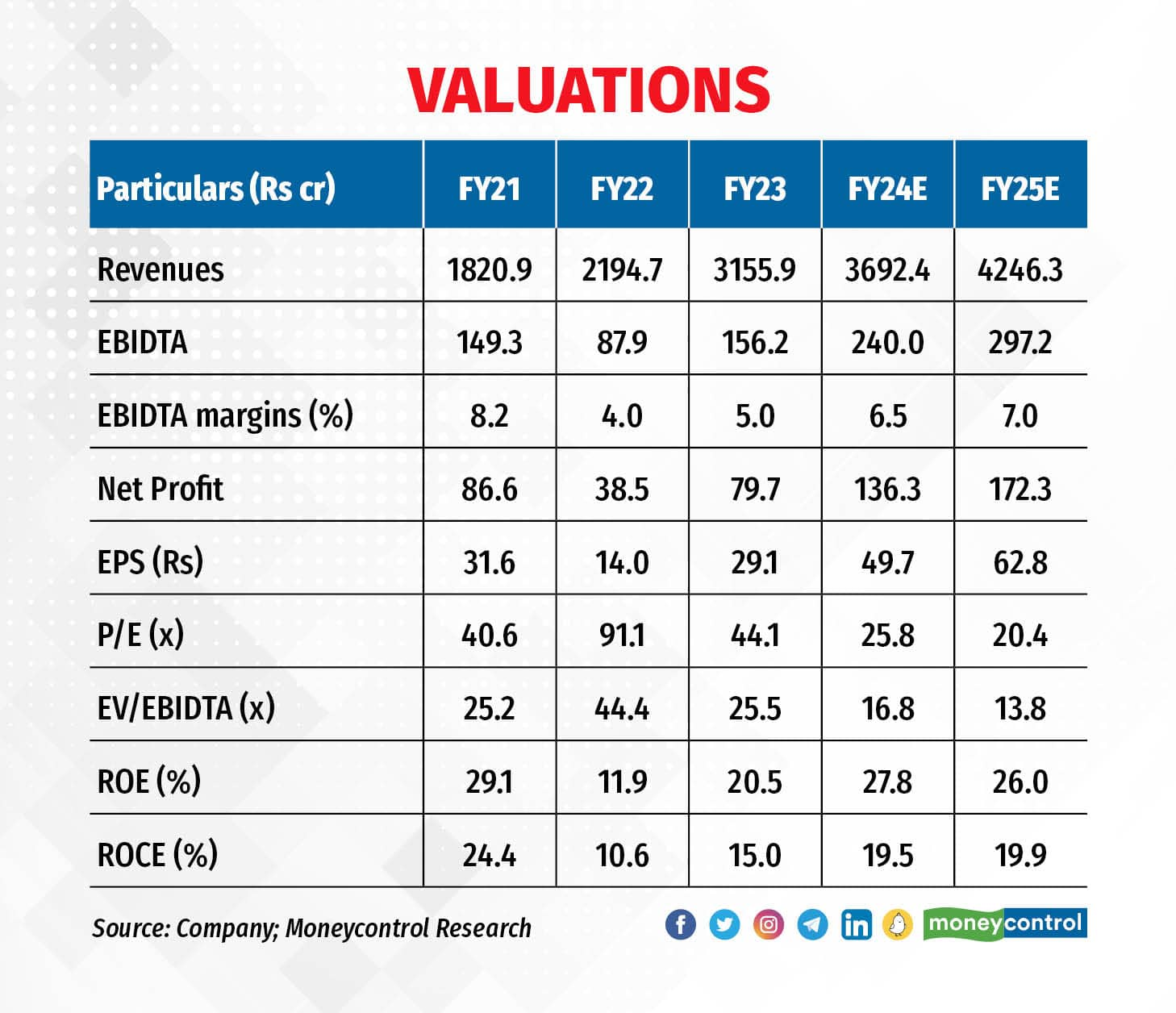

Valuations

At the current market price (CMP), the stock is trading at a P/E of 20 times FY25 projected earnings. TMJL has strong growth prospects as well as robust return ratios. We advise investors to add the stock in the portfolio.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | DPI, UPI, AI and finding a tech Neverland

Sep 8, 2023 / 02:38 PM IST

In this edition of Moneycontrol Pro Panorama: China's dam in Tibet proves costly for India, cries about AI safety gains momentum, ...

Read Now

Moneycontrol Pro Weekender: The road to 2047

Aug 12, 2023 / 10:56 AM IST

According to an RBI study, we need to grow real GDP by 7.6 percent per annum to be a developed economy. And that target is eminent...

Read Now