The Indian IT sector has been through a tumultuous ride in recent years. After a post-pandemic rally, the sector went through a series of reality checks, characterized by layoffs and slow growth. It was only around three months ago that the sector started showing signs of emerging green shoots, and that’s when we had highlighted the sector as an attractive opportunity for long-term investors. In the time since then, the IT sector has risen to the occasion and significantly outperformed the broader Nifty. In this article, we shall revisit the Indian IT sector’s journey and draw inferences on what the future could hold for the sector.

The Indian IT sector’s journey so far

After the pandemic, as work-from-home ensued, there was a radical shift in focus towards digitization and associated verticals including cybersecurity. A digital boom emerged, taking the Nifty IT index to life-time highs. This period was characterized by a hiring frenzy in order to cater to what seemed to be an ever-growing volume of new deals.

But soon, inflation concerns took over, leading to the most aggressive monetary tightening phase seen in decades. Tightening was the steepest in the US and Europe where the spike seen in inflation was practically unprecedented. To make matters worse, the impact of rate hikes on inflation was slow, leading to a prolonged period of very high rates which fueled fears of stagflation. FAANG stocks in the US and Indian IT companies that cater mostly to clients in the US and Europe bore the brunt of this rather sad turn of events. As companies cut back on their technology expenditure in the wake of macroeconomic headwinds, the deal pipeline dried out, and the hiring frenzy was quickly replaced by mass layoffs. The Nifty IT index corrected by more than 30 percent off its peak in this period.

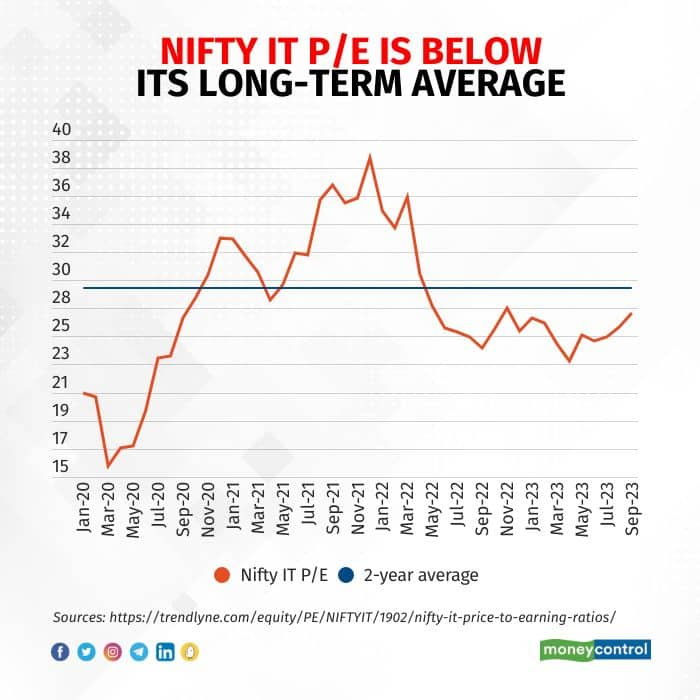

Over the course of the correction, the P/E of the Nifty IT index corrected from highs of almost 40 times seen towards the end of 2021, down to 23-24 times in April 2023. At the same time, inflation in the US and Europe finally started coming down to palatable levels and the US economy proved resilient too. As the global economy started showing signs of stabilization, revenue prospects of IT companies began looking up as well. Layoffs supported their margins too. Low valuations helped support the emerging green shoots in the Indian IT sector. This was when the sector started emerging as a good opportunity for long-term investors. In fact, since our analysis in early June, Nifty IT index has delivered almost 11% return, thereby significantly outperforming the Nifty which yielded a 6.5 percent return during the period.

What could the future hold?

During the latest upswing, the P/E multiple of the Nifty IT index has increased from 23 times to 27 times, thereby limiting room for further growth unless fundamentals catch up with the recent optimism. In the Q1 results for the sector, we saw very small growth in revenues and even de-growth in certain cases, despite Q1 being a conventionally strong quarter for the sector. But these results were along expected lines, and so, did not dent investor optimism around the sector. However, going forward, any disappointment on fundamentals could lead to a correction.

For example, while the US economy is widely expected to successfully sidestep a recession, the European economy has technically slipped into a recession. So, the proverbial light at the end of the tunnel may be further down the road for Europe than the US. Even in the US, while the broader economy has proved to be resilient in the face of rate hikes, following the collapse of a few US banks, the US banking sector has remained cautious in lending as well as in IT spending. This raises skepticism around the fortunes of Indian IT companies such as Mphasis which cater primarily to the US BFSI sector. Furthermore, artificial intelligence and its impact on conventional IT services is still a wildcard. So, it is important to keep tabs on the progress made by Indian IT companies in this still nascent field.

Having said that, despite the recent pickup in fortunes of the Indian IT sector, the sectoral P/E multiple is still well below its long-term average. Also, notwithstanding recent headwinds, the long-term potential of the sector is intact. The sector’s spot as an attractive investment avenue for long-term capital appreciation looks secure. Of course, short-term volatility and corrections could be on the cards as risks remain and valuations are higher than earlier, leaving little room to absorb any disappointments on the ground.

Ananya Roy is a fund manager. Twitter: @ananyaroycfa. Views are personal, and do not represent the stand of this publication.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | DPI, UPI, AI and finding a tech Neverland

Sep 8, 2023 / 02:38 PM IST

In this edition of Moneycontrol Pro Panorama: China's dam in Tibet proves costly for India, cries about AI safety gains momentum, ...

Read Now

Moneycontrol Pro Weekender: The road to 2047

Aug 12, 2023 / 10:56 AM IST

According to an RBI study, we need to grow real GDP by 7.6 percent per annum to be a developed economy. And that target is eminent...

Read Now