Groww Mutual Fund, among the smallest asset management companies in India, recently received approval from the Securities and Exchange Board of India for its Nifty Total Market Index Fund.

When launched, the Groww Nifty Total Market Index Fund would be first of its kind in India, spread over 750 stocks, including micro-caps. Here’s how this strategy works.

Under the bonnet

Groww Nifty Total Market Index Fund would be the first passive scheme in India that will offer exposure to 750 stocks, across all market capitalisations.

Unlike the Nifty 50, which is a blue-chip index, all stocks in the Nifty 500 and the Nifty Microcap 250 form part of the Nifty Total Market Index Fund. The fund will passively invest in the top 750 stocks across large-, mid- and small- capitalisation categories.

Also read | Account aggregators: Here’s how to share your MF data with your bank or advisors

The weightage of each stock in the index will be based on its free-float market capitalisation – shares readily available for trading.

The Nifty Total Market Index was launched by Nifty Indices in October 2021 with a base date of April 1, 2005.

“The strategy inherently helps investors to participate in a broader market,” said Ravi Kumar TV, founder of Gaining Ground Investment Services.

Unique proposition?

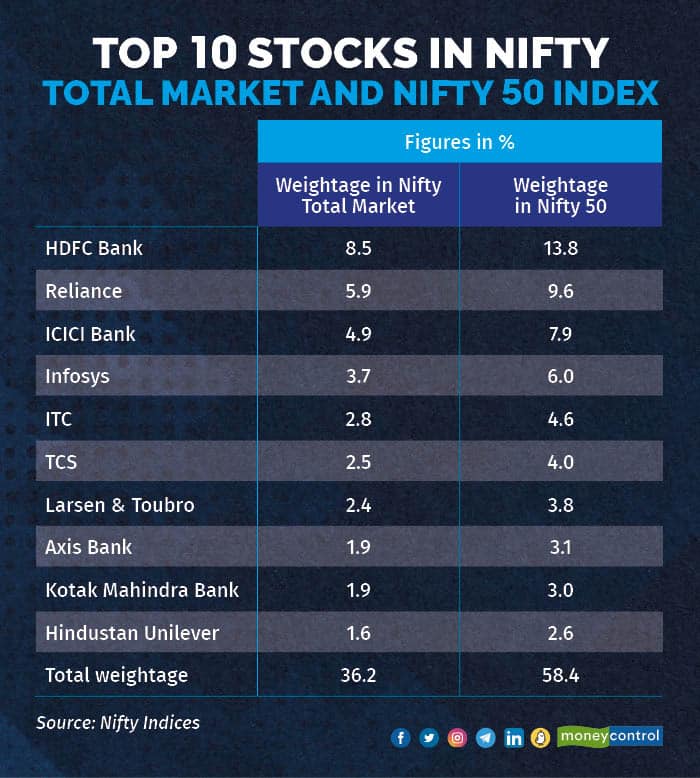

A look at index composition shows that top 10 stocks in terms of weightage in Nifty Total Market Index are same as that of Nifty 50 index.

According to factsheets on the Nifty indices, HDFC Bank is the top weightage stock in the Nifty 50 with 13.77 percent compared with 8.52 percent in the Nifty Total Market Index. Reliance Industries has a 9.56 percent weightage in the Nifty 50 against 5.92 percent in the Nifty Total Market Index.

The top 10 stocks in the Nifty Total Market Index have a combined weightage of 36.17 percent against 58.44 percent in the Nifty 50.

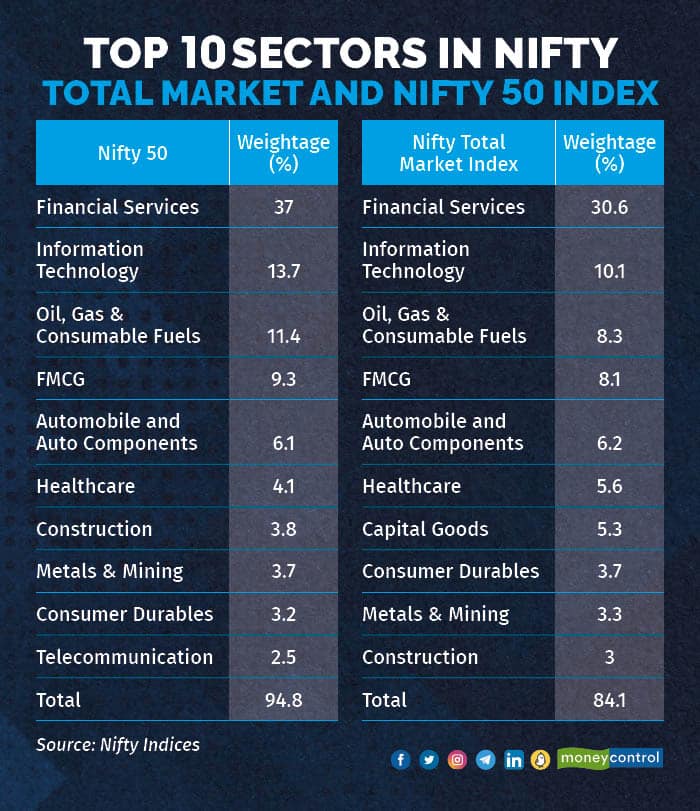

Even in terms of sectoral representation, the top five sectors in both indexes are the same, albeit with different weightages. However, in the Nifty Total Market Index, one can invest in additional sectors such as realty, textile and utilities, but their weightages are negligible to make a big difference.

Better returns?

Over the year ended August 31, the Nifty Total Market Index delivered returns of 11.37 percent compared with 9.53 percent for the Nifty 50. On a five-year basis, the Nifty Total Market Index’s returns were 12.54 percent compared with 11.84 percent delivered by the Nifty 50.

Also read | Inflation has deflated people's aspirations, shows BankBazaar study

Better returns in Nifty Total Market Index in the recent past could be because of outperformance by mid-cap and small-cap stocks over the past few years.

Keep in mind that mid-cap and small-cap stocks have the tendency to go through long phases of underperformance. During volatile markets they tend to fall more than large-cap stocks.

Data also shows that the Nifty Total Market Index has a correlation of 0.96 with the Nifty 50 index on a one-year basis and 0.99 on a five-year basis. A number closer to 1 indicates that the Nifty Total Market Index moves in tandem with the Nifty 50.

Does this strategy work?

There are passive and active funds in the market that invest individually in large-cap, mid-cap and small-cap stocks. Then there is Motilal Oswal Nifty 500 Index Fund that invests in top 500 Nifty companies through a passive strategy.

Nifty Total Market Index Fund also works like a passive multi-cap fund, where schemes have to mandatorily take a minimum 25 percent exposure to large, mid and small-cap stocks.

Experts believe that the success of this strategy will depend on the market cycle.

“However, you will be missing out on active selection. For example, at certain points in time, manufacturing, consumption, or credit cycle themes will work and you might want to have higher exposure to these three themes. Here, it won’t be possible. Further, the Nifty 50 is a much more liquid index,” said Kumar.

Some experts also pointed out that there are some positives in the strategy, too.

Also read | Don’t be loanly: Perk up your credit profile with these tips

“The biggest pro is that an investor gets to participate in the market without taking any sort of active fund management risks. So, this is suitable for a very limited set of investors, mostly very novice, first-time investors and fixed deposit graduates. It just helps them get a feel of how equity-oriented products work,” said Nirav Karkera, head of research at Fisdom.

Karkera added that the Nifty Total Market Index Fund is not a return-maximisation proposition or a risk-optimisation proposition as it is very thinly spread among 750 stocks.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!