The market has had a good run this month, so far, with the Nifty50 crossing the important 19,800 mark after seven weeks on September 8. Experts expect the index at 20,000 in the coming sessions if it manages to hold on to 19,700-19,600 but before that happens, some consolidation can't be ruled out.

The Sensex jumped 333 points to 66,599, while the Nifty rose 93 points to 19,820 to form a bullish candlestick on the daily charts, forming higher highs and higher lows sixth day in a row.

"The market has started to surpass one after another hurdles recently and is expected to move above the current resistance of 19,865 levels," Nagaraj Shetti, technical research analyst, HDFC Securities, said.

The short term trend continues to be positive, with immediate support at 19,650, he said.

The market breadth favours the bulls. Nifty midcap 100 and smallcap 100 indices gained 0.95 percent and 0.6 percent, respectively. The India VIX, the fear index, dropped 0.85 percent to 10.78, from 10.87 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may be taking support at 19,751, followed by 19,718 and 19,665. On the higher side, 19,858 can act as the key resistance followed by 19,891 and 19,945.

On September 8, Bank Nifty maintained its uptrend for yet another session and surpassed the crucial 45,000 mark. The index rallied 278 points to 45,156 and formed a bullish candlestick with long upper and minor lower shadows on the daily charts.

"After breaking out of the consolidation during the previous trading session it has witnessed follow- through buying interest. The momentum indicator has a positive crossover, which is a bullish sign. Overall, we expect the positive momentum to continue and expect targets of 45,500 from a short-term perspective," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

As per the pivot point calculator, the banking index is expected to take support at 44,899, followed by 44,764 and 44,546. On the upside, the initial resistance is at 45,336, 45,470 and then 45,689.

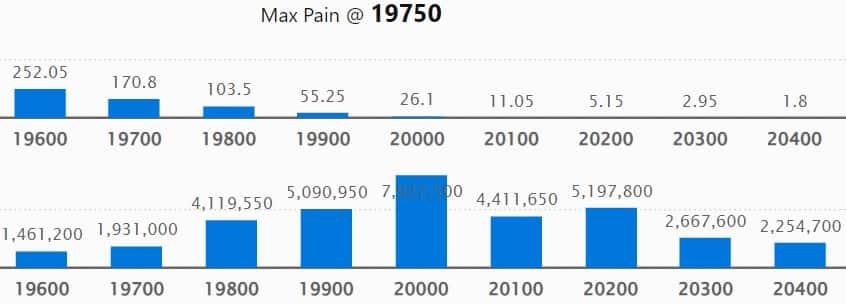

As per the options data, the maximum weekly Call open interest (OI) was at 20,000 strike, with 79.27 lakh contracts, which can act as a key resistance for the Nifty. It was followed by 20,200 strike, which had 51.97 lakh contracts, while 19,900 strike had 50.9 lakh contracts.

The maximum Call writing was seen at 20,000 strike, which added 29.97 lakh contracts, followed by 20,200 and 20,500 strikes, which added 23.05 lakh and 20.5 lakh contracts.

The maximum Call unwinding was at 19,700 strike, which shed 13.73 lakh contracts, followed by 19,600 strike and 19,400 strike, which shed 8.22 lakh contracts, and 77,000 contracts.

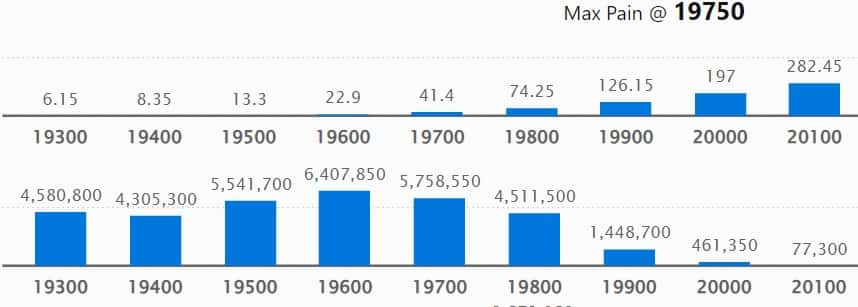

On the Put side, the maximum open interest was at 19,600 strike, with 64.07 lakh contracts. This can be an important support for the Nifty in the coming sessions.

It was followed by 19,700 strike comprising 57.58 lakh contracts, and 19,000 strike with 55.55 lakh contracts.

The maximum Put writing was at 19,800 strike, which added 37.14 lakh contracts, followed by 19,700 strike and 19,000 strike, which added 26.81 lakh and 19.33 lakh contracts.

Put unwinding was at 18,900 strike, which shed 4.18 lakh contracts followed by 18,800 strike, which shed 74,100 contracts.

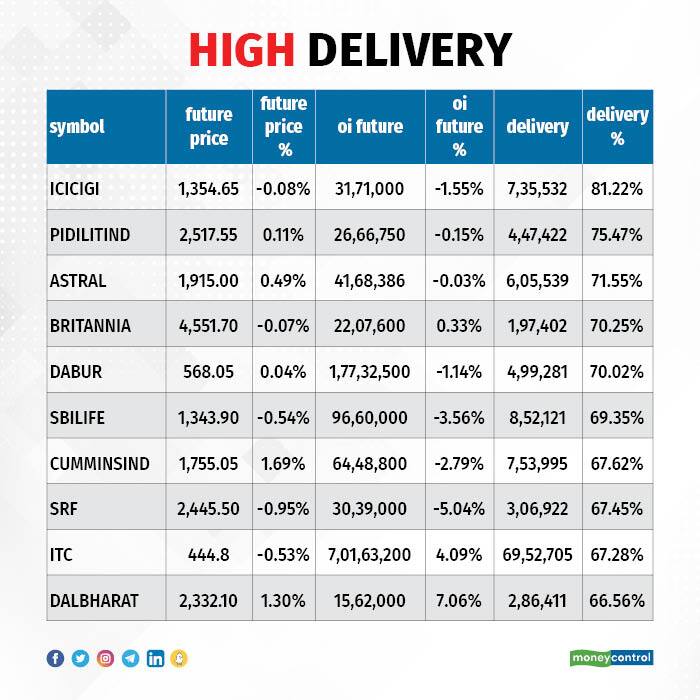

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. ICICI Lombard General Insurance, Pidilite Industries, Astral, Britannia Industries and Dabur India were among the stocks with the highest delivery.

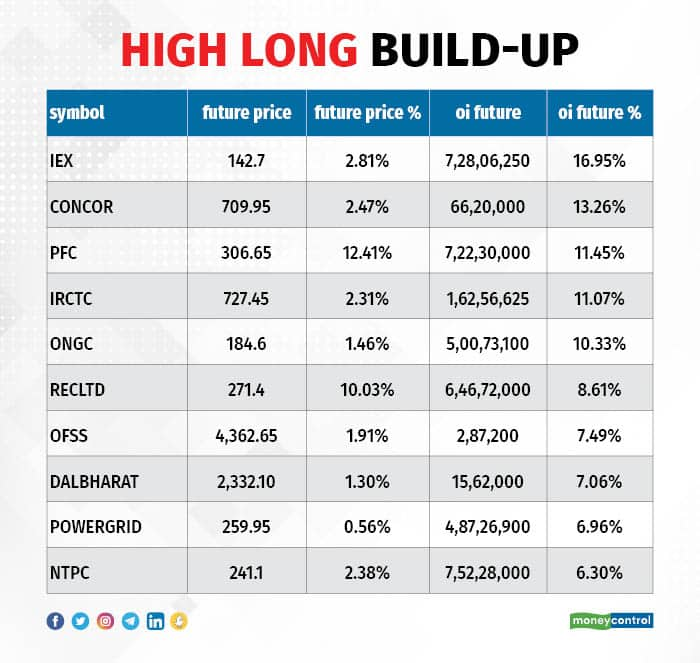

A long build-up was seen in 52 stocks, including the Indian Energy Exchange, Container Corporation of India, PFC, IRCTC, and ONGC. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 35 stocks, including Balrampur Chini Mills, SRF, SAIL, SBI Life Insurance Company and Bharat Forge, saw long unwinding. A decline in OI and price indicates long unwinding.

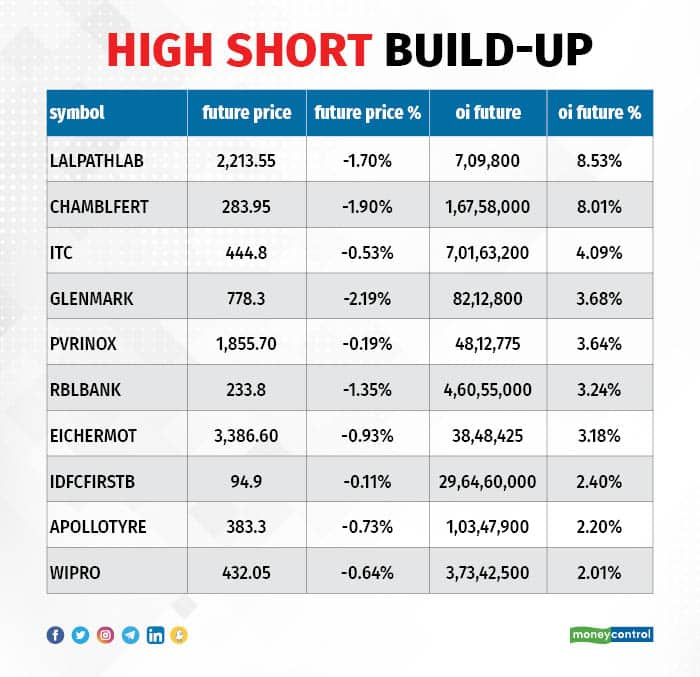

37 stocks see a short build-up

A short build-up was seen in 37 stocks. These included Dr Lal PathLabs, Chambal Fertilisers and Chemicals, ITC, Glenmark Pharma, and PVRInox. An increase in OI along with a fall in price points to a build-up of short positions.

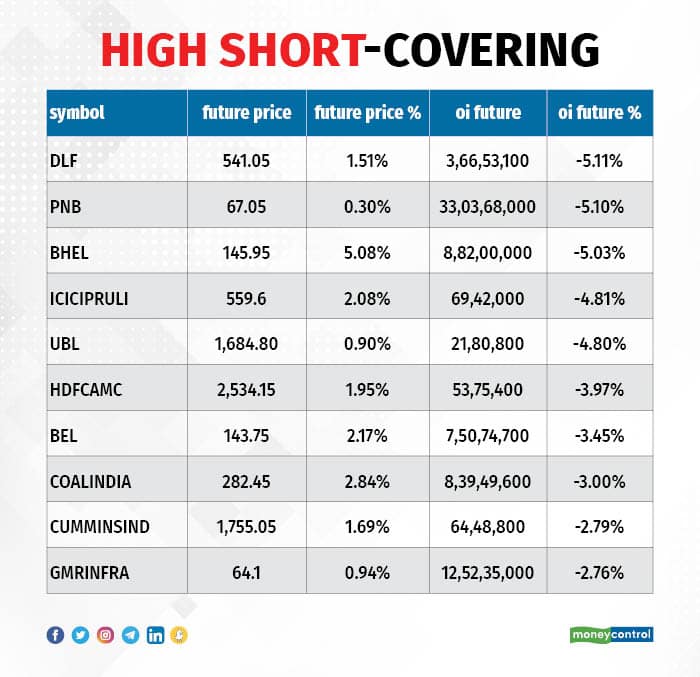

Based on the OI percentage, 62 stocks were on the short-covering list. These included DLF, Punjab National Bank, BHEL, ICICI Prudential Life Insurance, and United Breweries. A decrease in OI along with a price increase is an indication of short-covering.

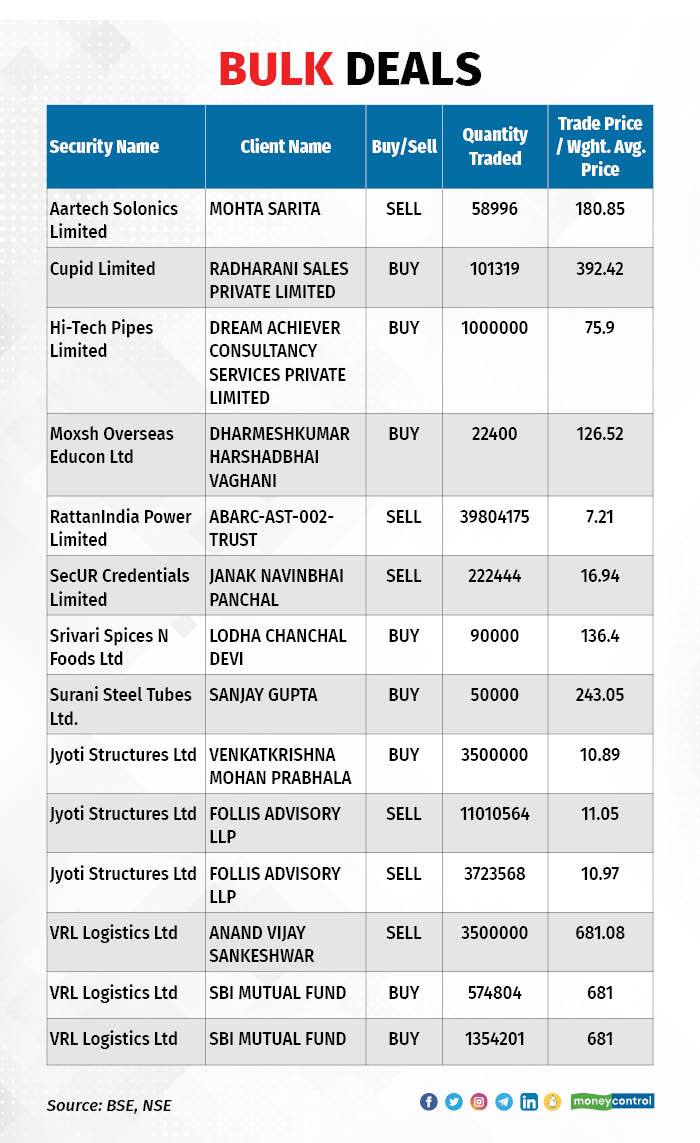

(For more bulk deals, click here)

Investors meeting on September 11

Stocks in the news

Rishabh Instruments: The test and measuring instruments maker will debut on the BSE and NSE on September 11. The final issue price has been fixed at Rs 441 a share.

Ratnaveer Precision Engineering: The stainless steel-based products manufacturer makes its market debut on September 11 after the listing date was brought forward from September 14. The final issue price has been set at Rs 98 a share.

Vakrangee: The technology company has signed a binding term-sheet with private equity investor Aaviskaar Capital to acquire a 48.5 percent stake in Vortex Engineering. Vortex is one of the leading providers of automated teller machines and, so far, has shipped more than 10,000 ATMs across India, Africa and South Asia and software to complement the hardware. The acquisition will help Vakrangee achieve backward integration.

Adani Enterprises: Adani Global Pte Ltd, Singapore, a step-down wholly owned subsidiary of the company has signed a joint venture agreement with Kowa Holdings Asia Pte Ltd, Singapore. They signed an agreement for the sales and marketing of green ammonia, green hydrogen and its derivatives produced and supplied by the Adani Group in the agreed territory.

SJVN: Subsidiary SJVN Green Energy has signed a power-purchase agreement with Bhakra Beas Management Board for 18 MW solar power project. The project will be developed on land parcels of BBMB in Himachal Pradesh and Punjab. The project is scheduled to be commissioned by August 2024.

Schaeffler India: The high-precision components and systems maker has acquired 100 percent shareholding of KRSV Innovative Auto Solutions. The acquisition was completed on September 8.

Gateway Distriparks: Sandeep Kumar Shaw resigned as the Chief Financial Officer and key managerial personnel due to personal reasons. Shaw's resignation will be effective November 28.

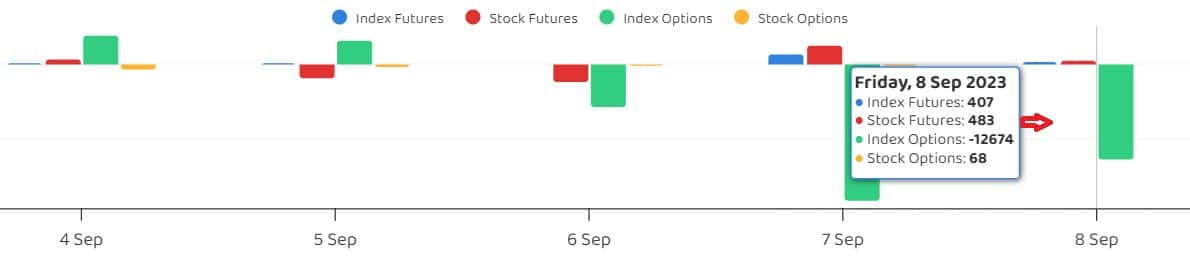

Fund Flow (Rs Crore)

Foreign institutional investors (FII) sold shares worth Rs 224.22 crore, while domestic institutional investors (DII) bought Rs 1,150.15 crore worth of stocks on September 8, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has added Chambal Fertilisers and Chemicals to its F&O ban list for September 11, while retaining Balrampur Chini Mills, Delta Corp, Hindustan Copper, Indiabulls Housing Finance, India Cements, Manappuram Finance, Punjab National Bank and SAIL. BHEL has been removed from the list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!