Highlights

As the company benefits from supportive geopolitics and domestic demand scenario, fresh capacity addition is expected to be announced.

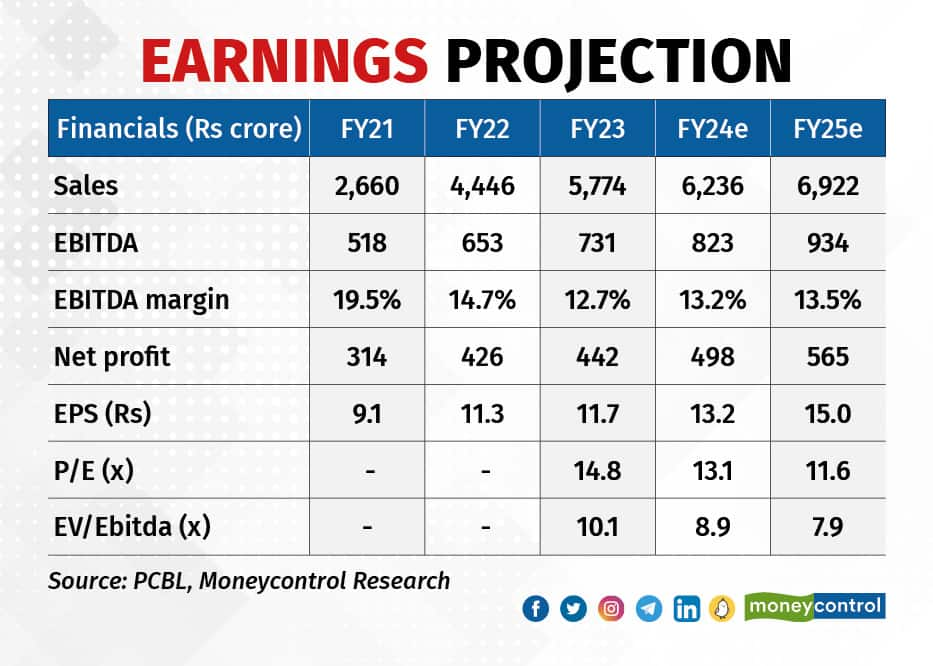

While growth visibility appears steady, valuations are still reasonable at a time when the entire mid- and small-cap landscape has re-rated in the last 5-6 months.

Domestic end market to remain prime growth driver

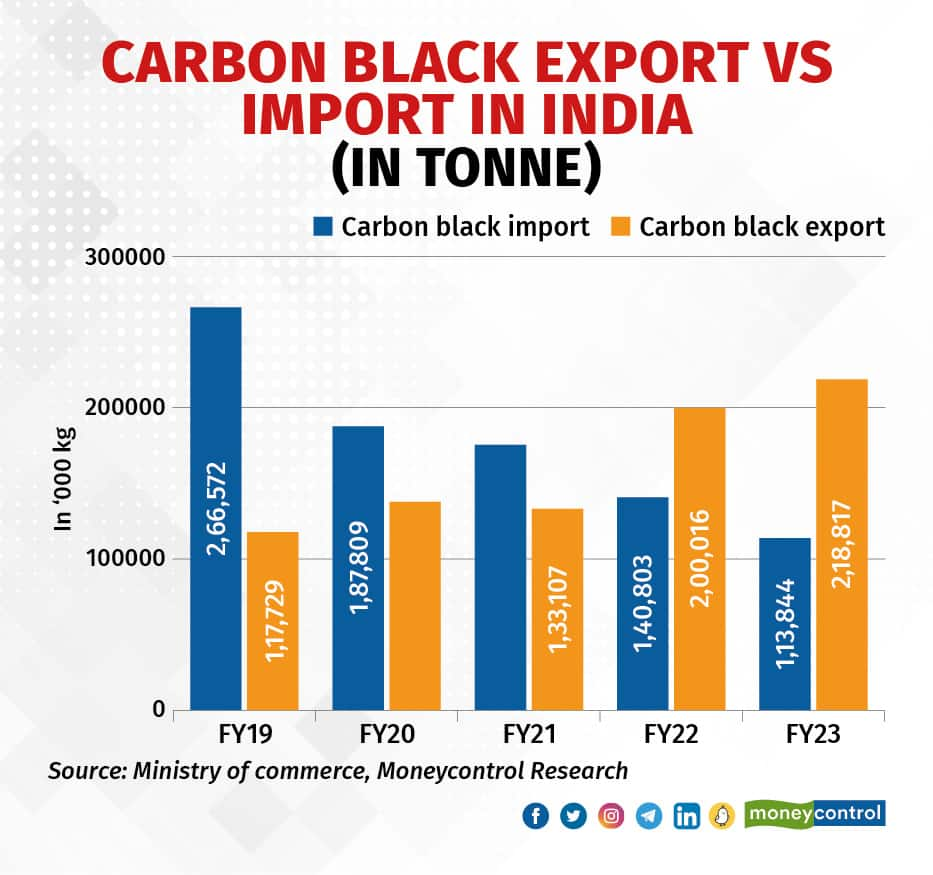

Import substitution remains a core driver of growth. The import of carbon black was to the tune of 2 lakh tonnes a few years back which has come down to nearly one lakh tonnes. While some import dependence would continue as a few grades are not manufactured in India, there is further scope for import substitution.

On the back of the expansion plans of the OEM segment and recovery in the replacement market, PCBL expects high single-digit volume growth in the next couple of years

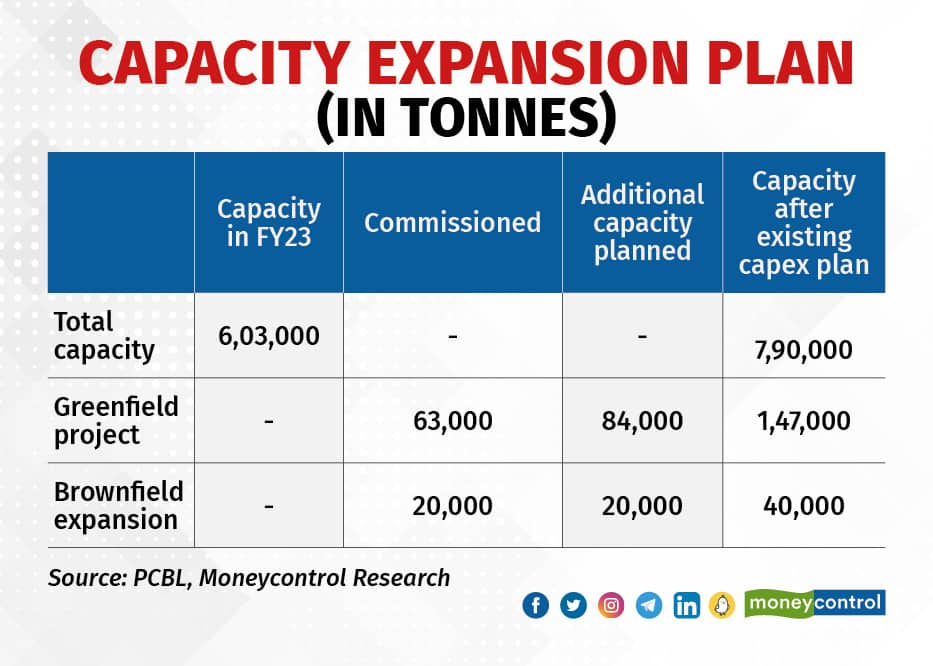

In this context, the greenfield project in Chennai assumes importance as it aims to add ~1,47,000 tonnes and targets the tyre industry in the vicinity. The first phase of this project (63,000 tonnes) was commissioned in April ’23 and is operating at a 45 percent utilisation level.

Growth in specialty applications

Greenfield project – phase 1

On the specialty front, the company continues to add capacity. Recently, it added a production line of 20,000 tonnes in Mundra, taking the aggregate specialty black capacity to 92,000 tonnes, which is 13 percent of the total. Another 20,000 tonnes are expected to get commissioned within a year.

Growing specialty applications in the areas of fibres, pressure pipes, coatings, wire & cables, food contact plastics, and engineering plastics remain the driving factor. Along with that, the company’s increased exports to Europe has a higher proportion of specialty grades. It is an interesting area to watch as, on an average, specialty grades command 2x EBITDA (earnings before interest, tax, depreciation, and amortisation) per kg versus normal grades. Among the specific areas to watch would be conductive grades used in conventional batteries and internal coating of electric wires. The company’s R&D team is also working on superconductive grades, which would be used for high-end EV batteries.

Outlook

Favourable geopolitics, which dictate diversification of supplies from Russia and China, has been a shot in the arm for the company in the last few years. While Russian supplies still find its way to Europe and Asia, they are less competitive as supplies need to be routed through longer and risker trade channels. Similarly, cost structure in China has changed over the years. Today landed cost of imports from these nations to India is generally on the higher side. This change in competitive dynamics is benefitting both fronts – import substitution and increase in the share in export markets.

Europe is now a significant export destination. A few years back, Europe constituted just 4 percent of export volumes, while the company expects it to rise to 20 percent in the current year.

That said, in the near-term international demand remains to be closely watched due to persistent inflationary conditions.

The company would have to take up another large capex in FY25-26. We believe the balance sheet with a net debt to equity ratio of about 0.31x has room to support further expansion plans.

While the volume mix between normal and specialty/ performance may remain in the range of 65:35 for the next two years, upside to margins will essentially come from the operating leverage in the more efficient new plants.

The key risks to watch in the near term is the sharp demand slowdown in the developed markets and the deterioration in the feedstock cost advantage. The company’s feedstock — CBFS (Carbon Black Feed Stock) — remains relatively cheaper to competing feedstock from the derivate of coal (CBO – Carbon Black Oil). This also makes it competitive to Chinese suppliers, which chiefly produce from CBO.

The PCBL stock has run up 45 percent from our recommendation a year back. However, valuations at EV/EBITDA of 7.9x for FY25e continue to remain at a discount to its closest peer and the chemical sector. Hence we remain constructive on the stock at the current level.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | DPI, UPI, AI and finding a tech Neverland

Sep 8, 2023 / 02:38 PM IST

In this edition of Moneycontrol Pro Panorama: China's dam in Tibet proves costly for India, cries about AI safety gains momentum, ...

Read Now

Moneycontrol Pro Weekender: The road to 2047

Aug 12, 2023 / 10:56 AM IST

According to an RBI study, we need to grow real GDP by 7.6 percent per annum to be a developed economy. And that target is eminent...

Read Now