In July 2023, several SBI card customers were surprised to receive a message with a reduced limit on their credit card. Soon, there were posts on social media against the company for taking this action without further reasoning about it.

“SBI card is not the only one which has reduced the credit limit on the card. There are other banks which have done it in the past, which includes HDFC Bank, RBL Bank and more,” Sumanta Mandal, Founder, TechnoFino, a platform that tracks the Indian credit card industry, said.

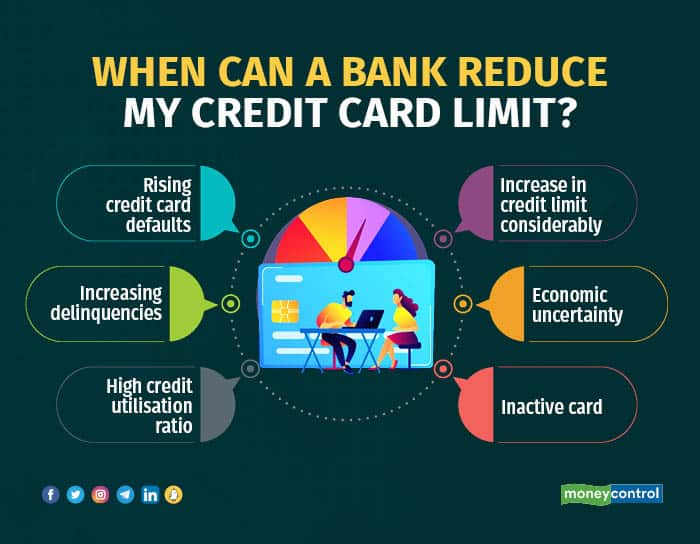

So what are the factors which can reduce your credit card limit?

Defaults on repayment of credit card dues

According to the Reserve Bank of India (RBI), credit card default rose to Rs 4,072 crore, or 1.94 per cent, at the end of March 2023 compared to the previous year, while credit card outstanding rose to Rs 2.10 lakh crore in March 2023 from Rs 1.64 lakh crore in March 2022.

“If you have delayed your credit card payments several times, your card issuer will consider you a risky borrower. As a result, your credit limit can get reduced,” said Ankur Mittal, Co-founder and Chief Technology Officer, Card Insider, a platform that tracks credit-card business.

Credit card payments also affect your credit score. “Timely payment of credit card bills positively affects your credit score, while late or missed payments can reduce your credit score significantly,” said Saikrishnan Srinivasan, MD, Experian Credit Information Company of India.

You should not carry forward the outstanding dues by paying only a minimum due amount. It’s important to repay the full amount every time to avoid falling into the debt trap.

Also read | Credit cards have much to offer than just credit; here are tips to get the best out of them

Increasing delinquencies for the bank issuing card

As per the report from Transunion Cibil, credit card payment defaults increased in the quarter ended June 2023. For credit cards over 90 days past due (dpd), the delinquency rate rose 66 basis points compared to the previous year to reach 2.94 percent (100 basis points equal 1 percentage point). Rising delinquencies are a concern for the banks.

“If a bank is observing increasing delinquencies beyond the comfortable thresholds or there is a strong recessionary or inflationary sentiment, the bank looks to tighten its credit policies,” Parijat Garg, a digital lending consultant, said. He added, in such a case, the cardholders who are on the lower end of the credit risk spectrum could experience such unanticipated actions.

Also read | Don't make these five credit card mistakes or you'll be in debt forever

High credit utilisation ratio

The credit utilisation ratio refers to the proportion between the amount of credit you have available and the amount you spend.

For instance, if the credit limit on your credit card is Rs one lakh and your average monthly spend comes to Rs 40,000, your credit utilisation is 40 percent. However, if you have two cards with limits of Rs 75,000 each, and your overall spend (both cards included) is Rs 40,000, your utilisation is 27 percent.

A lower credit utilisation ratio demonstrates that you are a prudent and responsible user of credit. Credit counsellors advise that the credit utilisation ratio should stay below 30 percent. “But if you are having high credit utilisation of 70 percent plus on an aggregated basis frequently, then it’s a red flag for a bank issuing the card and they can reduce the credit limit,” Garg said.

Lenders view borrowers with high utilisation ratios as potentially riskier. “A high utilisation ratio may indicate reliance on credit and difficulty managing debt, which can make lenders hesitant to extend additional credit or offer favourable terms,” says Adhil Shetty, CEO, BankBazaar.com.

Also read | Festive shopping offers from Amazon and Flipkart kicks in: How to make the most of shopping credit cards

Increase in credit limit drastically

Suppose you accumulate multiple credit cards over a period then your total credit limit will increase. “Total credit limit of a customer increases dramatically with time, bank red flags those customers as risky credit profiles and may reduce credit limit,” says Mandal. The bank gets that data from credit bureaus.

For instance, now you have ten credit cards and the total credit limit is Rs 50 lakh. After two years, you got 10 new credit cards and the total credit limit increased to Rs 1 crore in a short span of time. In such a situation, some banks may reduce your credit card limit.

Economic Uncertainty

“When the economy is uncertain and most people face a financial crisis, many card issuers reduce the credit limits for their credit cardholders in order to minimise the risk,” Mittal said. It is because there are high chances that cardholders cannot repay their dues on time in such situations. For instance, during the Covid-19 pandemic, many cardholders faced a reduced credit limit.

Also read | Higher spending, missed payments? Your credit card may be cancelled

Inactive card

If you use your credit card rarely, then your card issuer may decide to reduce your credit limit as they earn only when you use your credit card. “If your card has been inactive for a long time, your bank issuing the card will find it better to reduce your credit limit and increase the credit limit of another active cardholder so that there is a likelihood to earn in the form of charges, interest rates, etc,” Mittal said.

What should you do if your credit card limit is reduced?

“If the bank has reduced your credit limit without any prior notification, you should contact your bank customer care to explain the reason for the reduced credit limit,” said Mittal. Let the bank issuing the card explain their concerns. Then you can explain your issues, which led to a reduced credit limit. For instance, if you had missed payments due to some genuine reason, explain it to the bank and ask them to reassign the previous credit limit to you. After contacting the bank’s customer care, your credit limit may get reinstated.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!