Highlights

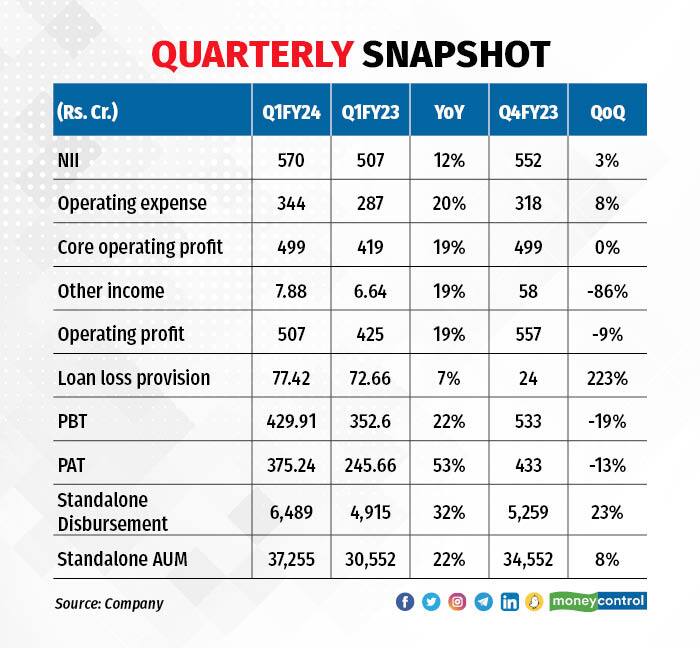

The year started on a healthy note with in-line June quarter results (Q1FY24). Net earnings jumped 53 percent on a year on year (YoY) basis to Rs 375 crore in Q1FY24 on the back of improved macros and a healthy demand from end-user industries.

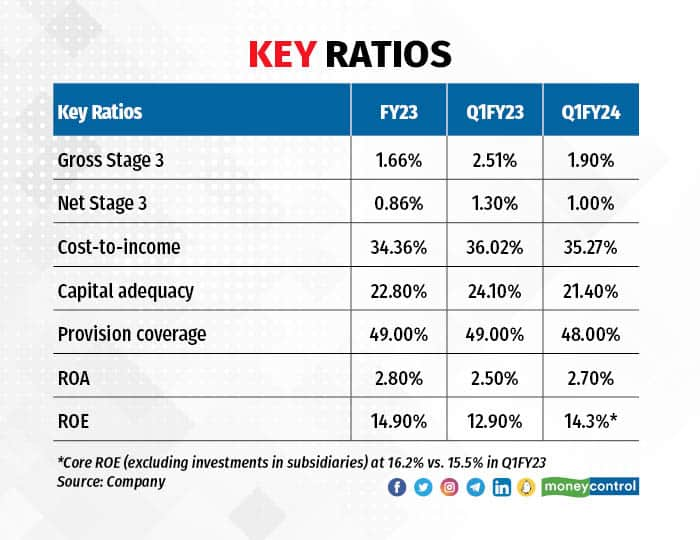

Although the GNPA (gross non-performing asset) ratio is higher than the FY23 level, the new asset book quality is good. Going forward, the company’s endeavour is to consistently deliver measured growth and profitability, while ensuring the best-in-class asset quality.

The stock offers multi-year growth opportunity, backed by strong sector tailwinds.

Loan growth momentum healthy

After facing challenges in the previous quarter, the June quarter saw a record sequential growth in disbursement (up 23 percent QoQ), led by passenger vehicles, equipment financing, and commercial lending.

The highest-ever disbursement in Q1 was broad-based across asset categories and geographies and led to healthy expansion in the asset under management (AUM), which stood at Rs 37,255 crore as of June end (up 22 percent YoY).

The CV segment (47 percent of AUM) continues to dominate the loan book with higher contribution from southern regions. Retail-focused CV finance and housing finance remain growth drivers on the back of structural factors.

The strong foothold in southern states (56 percent of AUM) drives strong pricing power, while the strategic focus on expanding the presence in north ensures adequate diversification. A total of 59 branches were added in the last one year, out of which 32 branches were added in the north.

Profit dipped sequentially on higher credit cost

Higher opex (branch expansion) led to a muted sequential growth in core operating profit, which coupled with higher provisions resulted in a contraction in net profit in Q1 sequentially (profit down 13 percent QoQ).

Asset quality continues to remain best-in-class

Although, higher than FY23 levels (1.66 percent), the GNPA ratio improved by 61 basis points compared with the same quarter last year to 1.9 percent.

The total restructured assets stood at Rs 538 crore, around 1.5 percent of loan outstanding as on June 30, 2023.

Amid challenges the company is treading cautiously and has increased credit provisioning in Q1. We believe that with stable asset quality, backed by improved collections and recovery (back to pre-Covid levels), profitability can only look up.

Also, the company maintained a comfortable provision coverage ratio of 48 percent in Q1, which adds to confidence.

Improved performance by subsidiaries

Sundaram Home Finance — The lender saw a 5 percent QoQ growth in AUM, which stood at Rs 11,699 crore (around 64 percent are housing loans). Home loan demand remains strong in tier 2/3 towns in the southern markets, and will be a key growth driver, going forward.

Moreover, sharp improvement was seen in gross stage 3 assets (down 130 basis points YoY to 2 percent) in Q1.

RSGI (Royal Sundaram) reported a gross written premium (GWP) of Rs 908 crore (up 14 percent YoY) in Q1. Profit surged in Q1 led by net gain on equity investments compared with net loss in the corresponding quarter (PAT at Rs 95 crore in Q1FY24 against net loss of Rs 34 crore in Q1FY23).

Asset management subsidiary Sundaram AMC posted a strong sequential growth in AUM (up 9 percent QoQ) led by equity portfolio.

Outlook

The improvement in asset management and insurance businesses in the June quarter was attributed to the company’s strategic focus on scaling up these businesses.

The Home Finance segment’s growth strategy is to pivot around self-employed customer segments. As part of its growth strategy, the company opened 8 new branches during Q1 in Tier 2/3 towns in south India (total 125 branches as at June end). The new management team has been working on southern markets where housing demand remains robust.

Margin trajectory – The retail CV share in the AUM grew from 17.6 percent in Q1FY23 to 21.9 percent in Q1FY24, which, coupled with high-yield non-housing loans, will likely support margins in the coming quarters (disbursement share increased from 39 percent in Q1FY23 to 49 percent in Q1FY24). Spreads are expected to be range bound between 4.5-5 percent in the long term, according to the management.

As economic activity gathers pace before the festival season, and if the monsoon turns out to be normal, the management expects the current momentum to sustain in the coming quarters.

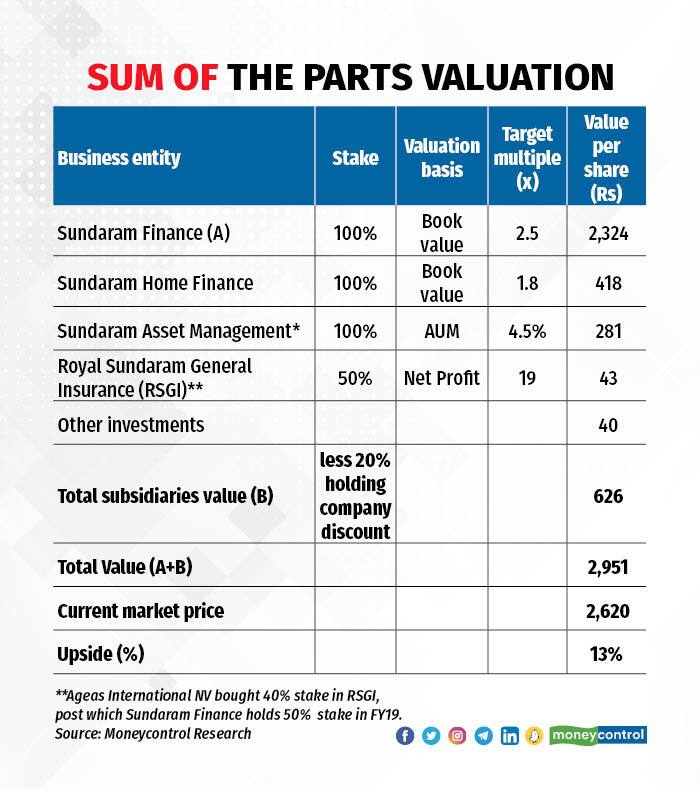

We have valued the stock on a SoTP (sum of the parts) basis and see a reasonable upside at the current market price.

For more research articles, visit our Moneycontrol Research page

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | DPI, UPI, AI and finding a tech Neverland

Sep 8, 2023 / 02:38 PM IST

In this edition of Moneycontrol Pro Panorama: China's dam in Tibet proves costly for India, cries about AI safety gains momentum, ...

Read Now

Moneycontrol Pro Weekender: The road to 2047

Aug 12, 2023 / 10:56 AM IST

According to an RBI study, we need to grow real GDP by 7.6 percent per annum to be a developed economy. And that target is eminent...

Read Now