On September 4, Zerodha Mutual Fund, one of the newest entrants into the Rs 45 lakh crore Indian mutual funds industry, filed draft papers with the capital market regulator, Securities and Exchange Board of India (Sebi), for launching its first two passive funds.

Interestingly, the asset management company (AMC) has chosen the Nifty LargeMidcap 250 index as the basis for both equity-linked savings scheme (ELSS) and non-ELSS offerings.

In recent times, there has been a lot of activity in the passive space, with fund houses gradually launching more and more options for passive investors. While having many options is good, too many in the passive space (just like active funds) will confuse investors.

Nevertheless, let’s see what exactly this index is.

What is Nifty LargeMidcap 250 Index?

It combines two existing indices – the Nifty 100 and the Nifty Midcap 150. It allocates equally, i.e., 50 percent each between largecaps (via top 100 companies in Nifty 100) and midcaps (via 150 companies in NiftyMidcap 150).

This is unlike pure market-cap weighted indices, in which the weightage of the constituent stocks are decided by the market cap of the companies.

So, to put it very simply, Nifty LargeMidcap 250 = 50% of Nifty100 + 50% of Nifty Midcap 150.

Also read | Zerodha MF gets ready to launch its first two schemes; files draft documents with SEBI

Looking under the hood of Nifty LargeMidcap 250

We know that Nifty 100 itself is made up of Nifty 50 and Nifty Next 50. But as I wrote earlier about why Nifty 100 is not exactly Nifty 50 + Next 50, the allocation of Nifty 50 is about 85 percent in Nifty 100.

And this brings us to an interesting finding. While Next 50 qualifies as a largecap index by itself, in practice, Nifty Next 50 has a risk-return-volatility profile that resembles midcaps more. Here’s why.

So while Nifty LargeMidcap 250 aims to provide equal exposure to the largecap and midcap segments, in reality, only the Nifty 50 stocks (from 250 in the index) behave like largecaps. The remaining 200 stocks forming part of the Next 50 and Midcap 150 index are more like midcaps.

So, it is possible that when it comes to performance, the returns of Nifty LargeMidcap 250 will be more in line with midcaps than largecaps, even though the allocation is optically set at 50 percent each.

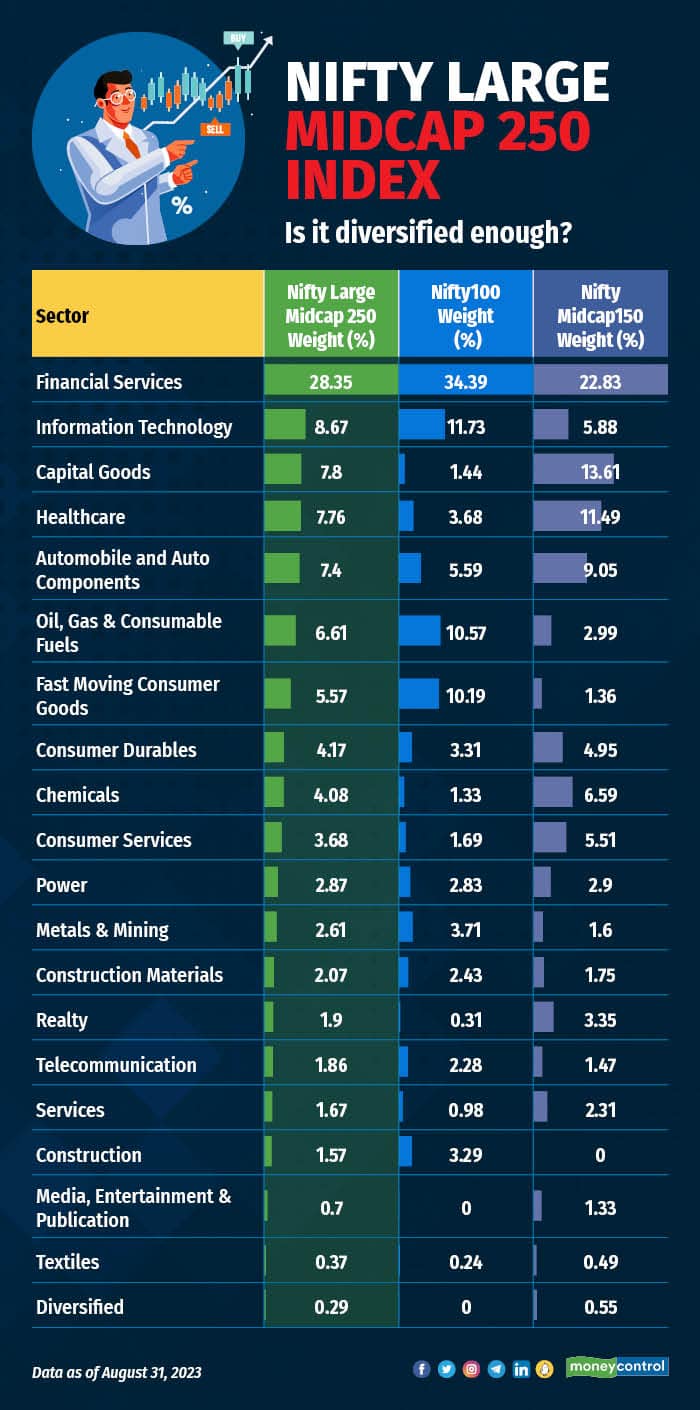

Clearly, the index has more diversified sectoral exposure than Nifty 100 and probably also versus Midcap 150.

Also, the total weightage of the top 10 stocks in Nifty LargeMidcap 250, at 24.1 percent, is less, compared to the Nifty 100, where the top 10 stocks have a total weightage of 50.2 percent. But it is higher than 16.74 percent of the Midcap 150 index.

Nifty LargeMidcap 250 return profile

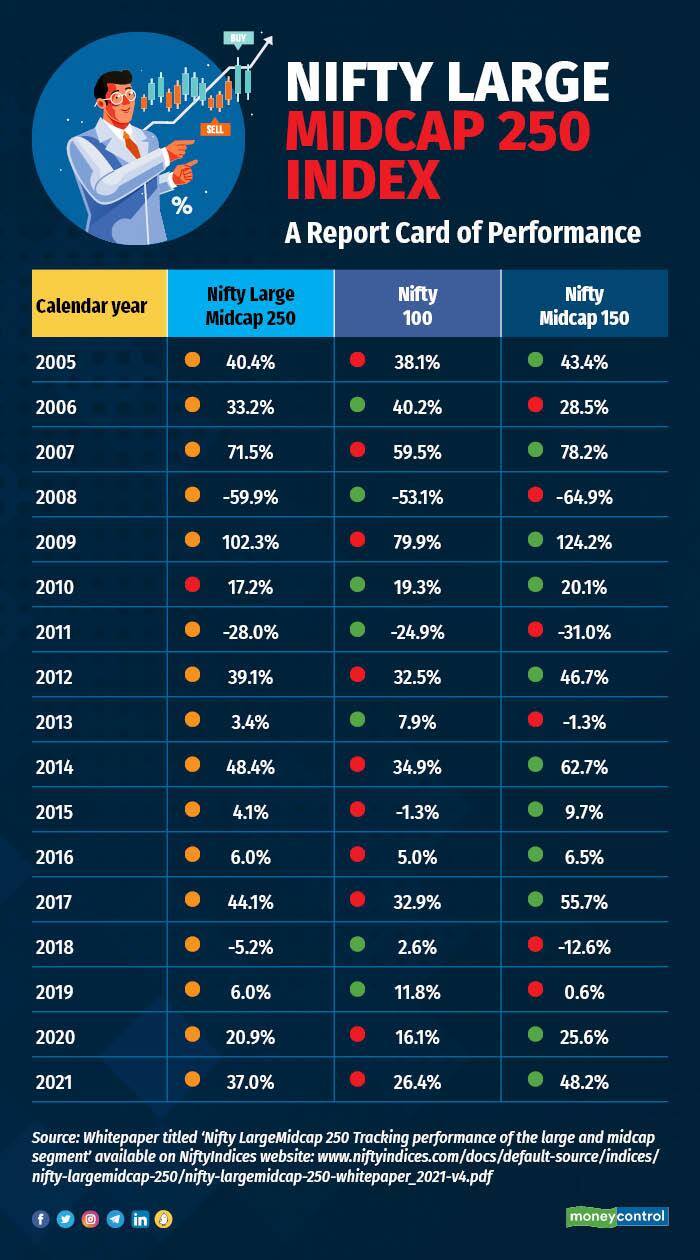

Given the equal allocation of large and midcap stocks in Nifty LargeMidcap 250, we need to acknowledge first that if there is a largecap-fuelled rally, this index will not do as well as a pure largecap fund (or index). Similarly, if the rally is midcap-fuelled, once again a pure midcap index or fund will do better than this. So, under most circumstances, the return outcomes will tend to lie between what pure largecaps or pure midcaps would deliver. And that is the entire premise on which this index is based.

A whitepaper published on NiftyIndices* shares the following comparative return profile:

Do note that the index came into existence only in 2017 though it has a base year of 2005. So, we don’t have a lot of actual past data to infer a lot from this return analysis.

Should you invest in the Nifty LargeMidcap 250 index fund?

The Nifty LargeMidcap 250 index tries to offer the best of both large as well as midcap worlds. So, no doubt it is an interesting offering.

For passive investors who were till now vary of skewness towards largecap in indices like Nifty 50, Nifty 100, etc., the Nifty LargeMidcap 250 index might be worth considering. And given its 50 percent allocation to each, it takes care of allocation dilemma between large and midcaps.

But having said all that, it is not for everyone. Having 50 percent allocation to midcaps (and even more if we understand that Next 50 stocks, which are part of this index, generally behave like midcaps), this scheme is not suitable for everyone and is best suited for fairly aggressive investors.

For most common investors in India, a larger allocation to the largecap segment is better suited. Also, if one already has some allocation to Next 50 or Midcap 150 funds alongside largecap funds, then funds based on this index will not serve any purpose, given the portfolio overlaps.

While the index itself is interesting, only one AMC (Edelweiss) has shown interest in launching a fund in this space and still has just about Rs 60 crore in AMC. So, with a new AMC launching two schemes on this index, while the AUM of the space will increase, it is still early days for the index itself. There should be no hurry to invest for now.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | DPI, UPI, AI and finding a tech Neverland

Sep 8, 2023 / 02:38 PM IST

In this edition of Moneycontrol Pro Panorama: China's dam in Tibet proves costly for India, cries about AI safety gains momentum, ...

Read Now

Moneycontrol Pro Weekender: The road to 2047

Aug 12, 2023 / 10:56 AM IST

According to an RBI study, we need to grow real GDP by 7.6 percent per annum to be a developed economy. And that target is eminent...

Read Now