Zepto's $200 million funding round which gave India its first unicorn of 2023 failed to propel the overall investment numbers as funding to the country's startup ecosystem fell over 30 percent in August from a month earlier.

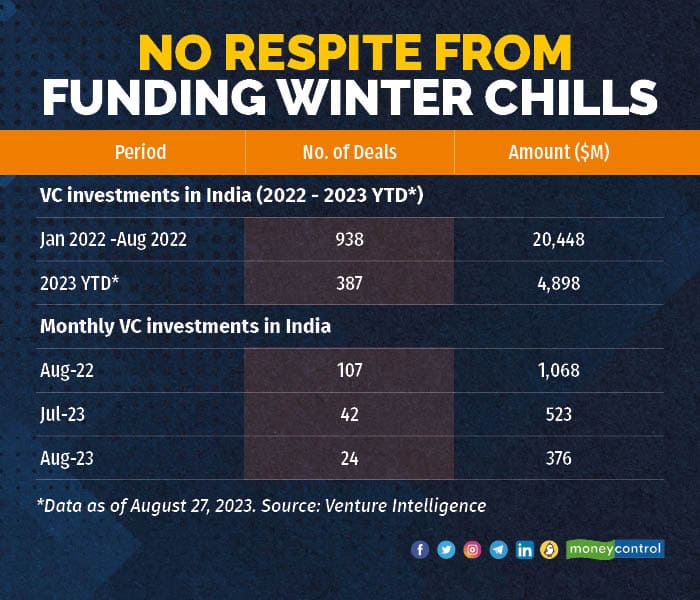

Indian startups raised $376 million in private equity and venture capital (PE/VC) funding in August 2023, down from $523 million in July, according to data shared by Venture Intelligence. This is despite Zepto’s massive $200 million fundraise, which valued the quick commerce company at $1.4 billion. Startups secured only 24 funding deals in this period, compared to 42 in July, data showed. In the same month last year, Indian startups received about 107 deals valued at $1.068 billion.

No respite from funding winter chills

No respite from funding winter chills

Also Read: Funding to Indian startups fell 77% from Jan-July 2023 over 2022

This comes at a time when valuations in the startup ecosystem are under pressure, as investors reassess the true size of India's market. Moreover, investors are increasingly looking to fund sustainable ventures with a clear path to profitability.

“It all boils down to performance, growth and cash runway. If a company has high growth with good margins, it should be able to justify its valuation or grow into its valuation. Companies with high performance or enough cash runway or both will not face repricing pressure,” Navjot Kaur, associate director at Epiq Capital told Moneycontrol.

Top deals of 2023

Top deals of 2023

From January to August 2023, there have been 387 deals amounting to $4.89 billion. In comparison, the same period last year witnessed a higher volume of investments, with 938 deals totalling $20.44 billion.

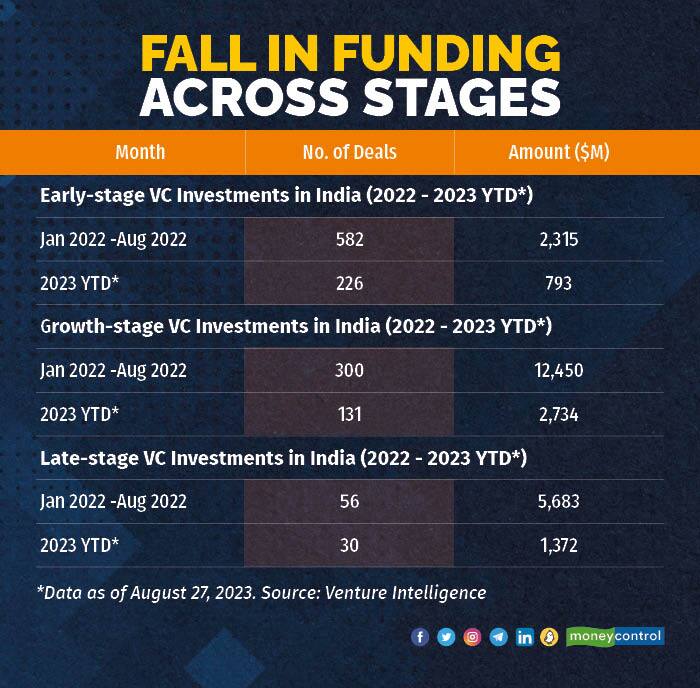

There have been only 30 deals with $1.372 billion investment to date, while last year 56 late-stage investments amounting to $5.683 billion were recorded from January to August.

This year, the early-stage category accounted for only 226 deals, totalling $793 million, compared to 582 deals valued at $2.315 billion during the same period last year. The growth stage attracted 131 deals with an investment sum of $2.73 billion, whereas there were approximately 300 growth-stage investments totalling $12.45 billion last year.

Fall in funding across stages

Fall in funding across stages

Investors, however, are bullish on increased investments in the next few months as valuations generally across the ecosystem have now hit bottom.

“In about the next six to nine months, you're going to see a rally in private markets because now you're starting to see really low, rock-bottom valuations. That is usually a precursor that things are going to get better,” said Anirudh Damani, managing partner, Artha Ventures.

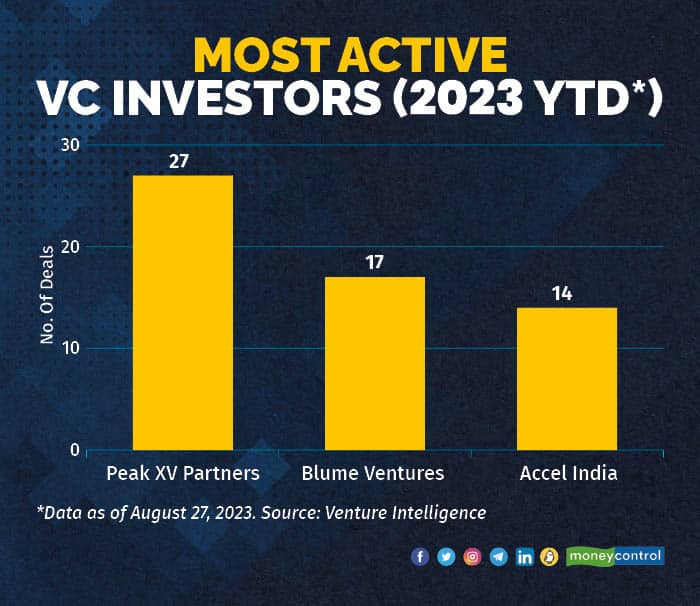

Among the most active VCs, Peak XV Partners (formerly Sequoia India) led with 27 deals, followed closely by Blume Ventures and Accel India with 17 and 14 deals, respectively.

Most active investors of 2023

Most active investors of 2023

After the top three, Lightspeed Venture Partners and Rainmatter Capital each made 11 deals, while Nexus Venture Partners and Anicut Capital each invested in 9 companies this year.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!